On October 27, Uzbekistan held parliamentary elections, which, along with the referendum in Kazakhstan and upcoming local council elections in Kyrgyzstan, contributed to a global election year.

In the elections in Uzbekistan, the ruling Liberal Democratic Party emerged victorious, participating for the first time in elections held under a mixed majoritarian-proportional system. As a result of the vote, the Liberal Democratic Party received 42,7% of the votes, securing 64 out of 150 seats in parliament. Voter turnout was 74.72%, and observers noted the organization and conduct of the elections.

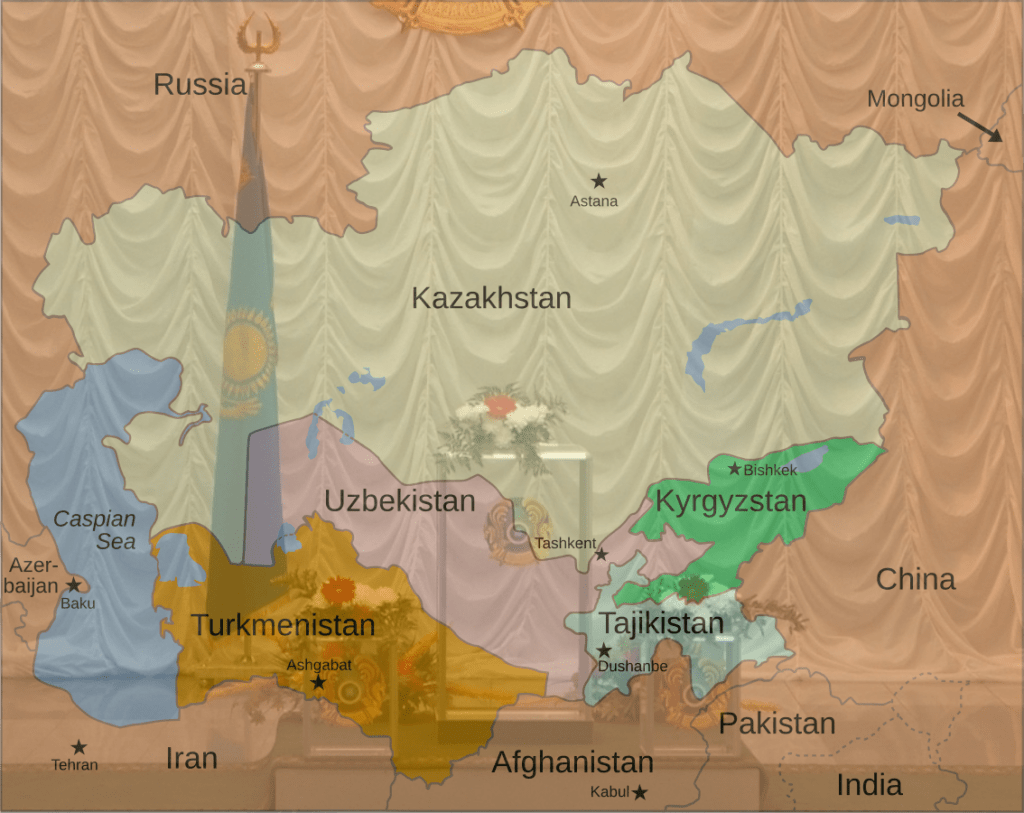

Leaders in Central Asia frequently cite the region’s volatile geopolitical landscape as a basis for more cautious internal reforms. This reflects a need to maintain stability in the face of external pressures.

Historically and currently, Central Asian countries do not represent homogeneous societies. Additionally, increasing political divisions within society and among political elites are observed in almost all five countries of the region. Against this backdrop, escalating geopolitical conflicts on the global stage may further hinder the realization of major political reforms.

Political Reforms and an Unstable World Order

It’s challenging to definitively assess political reforms in Kazakhstan and Uzbekistan as either negative or positive, as both perspectives exist. European and American leaders often note the countries’ aspirations for reforms and express readiness to support them. Therefore, Kazakhstan and Uzbekistan effectively act as locomotives of political reforms in Central Asia at this stage.

Under the leadership of President Kassym-Jomart Tokayev, Kazakhstan has undertaken political reforms aimed at modernizing the political system and strengthening democratic institutions. A significant step was limiting presidential powers by introducing a single seven-year presidential term without the right to re-election, which should promote regular changes in political leadership. Kazakh authorities argue that the role of parliament has also been strengthened to increase its influence and accountability to the government, providing a more balanced system of checks and balances. Liberalization of the party system included simplifying the registration of political parties and introducing elections based on single-member districts, which should foster political pluralism. Steps were taken to increase citizen participation in governance, including the introduction of direct elections for village and district mayors and creating mechanisms for open citizen feedback. Additionally, a 30% quota for women, youth, and people with disabilities was introduced in party lists, contributing to strengthening gender equality.

Under President Shavkat Mirziyoyev, Uzbekistan is also conducting significant reforms aimed at democratizing the political system. These elections were noteworthy for the introduction of a mixed electoral system, representing a significant departure from past practices. Under this system, 150 seats in the Legislative Chamber of the Oliy Majlis should be filled by two methods: 75 seats were elected through single-member districts (majoritarian system), and the remaining 75 were allocated proportionally based on party results (proportional system). This approach aims to enhance political pluralism by allowing both individual candidates and political parties to gain representation. The majoritarian component allows voters to directly elect representatives from their constituencies, fostering a closer connection between elected officials and their constituents. Meanwhile, the proportional component ensures that political parties receive seats proportional to their share of the vote, promoting diversity in parliament. The EU welcomed the progress made during these elections under the revised legal framework, particularly recognizing the efforts to facilitate voting for people with disabilities and the achievement of a minimum of 40% of seats in the new parliament being held by women.

India sent the largest group of observers, with over 20 representatives, including Chief Election Commissioner Rajiv Kumar, diplomats, and academics, to monitor the electoral process. This followed Prime Minister Narendra Modi’s recent bilateral meeting with Uzbek President Shavkat Mirziyoyev in Kazan, held alongside the BRICS Summit. Uzbekistan had also recently joined BRICS as a partner country. India and Uzbekistan shared strong civilizational, historical, and political connections.

OSCE also released a report on the elections. The report concludes that although some reforms show progress, major legislative and practical improvements are needed for Uzbekistan to meet democratic standards fully. But in reality, the progress achieved in democratic processes amid global geopolitical instability is also very important.

Historical Context of Uzbekistan’s Electoral System

To understand the significance of these reforms, it’s important to consider the historical context of Uzbekistan’s electoral system. Since gaining independence from the Soviet Union in 1991, Uzbekistan has undergone several electoral cycles. During Islam Karimov’s rule, Uzbekistan operated a centralized political system with limited space for political opposition. The electoral process primarily supported the continuity of the established power structure, rather than serving as a primary channel for political change.

Mirziyoyev’s administration is seeking to break from this legacy by introducing reforms aimed at increasing transparency, accountability, and citizen participation in governance. The adoption of a new Constitution was aimed at strengthening human rights protections and achieving sustainable development goals by 2030. Women’s representation in politics was also increased by raising the minimum number of female candidates from parties.

The Impact of Geopolitical Situations on Reforms

Escalating geopolitical conflicts on the global stage may further hinder the realization of major political reforms. The global environment plays a crucial role. The most democratically developed states have evolved in stable and peaceful conditions. Central Asian countries now face several challenges, such as combating the potential rise of terrorist organizations or fighting criminal groups. Additionally, the war in Ukraine has negatively affected the economic development of countries in the region.

In his latest Address to the Nation on September 2, President Tokayev noted: “our society must be governed by law and order. This is a fundamental condition for ensuring both public and individual security. Only in this way can we create a Just, Clean, and Safe Kazakhstan. To achieve this strategic goal, it is necessary to create favorable external conditions for the peaceful and sustainable development of the country. This is the task of diplomacy, which, in the current complex geopolitical realities, must be highly professional.”

How Geopolitical Challenges Can Affect Central Asian Countries

Central Asian countries have noticeably intensified joint efforts in combating terrorism and cooperation in security. On May 16, 2024, the first meeting of security secretaries of Central Asian countries took place. President Tokayev noted that high risks remain associated with the activity of international terrorist organizations. At the 6th Consultative Meeting of Central Asian Leaders, President Shavkat Mirziyoyev of Uzbekistan proposed developing a Concept for Ensuring Regional Security and Stability.

The worsening international situation inevitably impacts Central Asian countries. Since 2022, almost all countries in the region have faced political transformations. The war in Ukraine had certain advantages for Central Asian countries, but they also faced several challenges: inflation caused by various economic factors led to a significant increase in prices for food and non-food items. Serious logistical problems arising from sanctions negatively affected the region, limiting countries’ abilities to export and transport goods, as many important trade routes pass through Russia. This constrains trade and introduces uncertainty into transportation flows, making the region more vulnerable to external economic factors. Uncertainty is also growing regarding future borrowing costs, inflation levels, and energy prices, adding complexity to long-term planning and financial stability, especially amid global economic instability.

Comparative Analysis: Lessons from India and the United States

The experiences of India and the United States can provide Uzbekistan and other countries in the region with valuable lessons in striving to improve democratic processes.

India possesses one of the largest and most complex democracies in the world, with a robust electoral system that has evolved over decades. The independent electoral body, the Election Commission of India (ECI), is an autonomous constitutional authority responsible for conducting free and fair elections across the country. Its independence is crucial for maintaining impartiality and trust in the electoral process. India also uses Electronic Voting Machines (EVMs) with Voter-Verified Paper Audit Trails (VVPAT) to ensure transparency and accuracy in voting. This technology has played a significant role in reducing fraud and increasing voter confidence. Additionally, India’s electoral system emphasizes inclusivity by ensuring polling stations are accessible to all citizens. Recently introduced measures facilitate home voting for seniors and persons with disabilities, reflecting a commitment to expanding voter participation.

The United States offers a different perspective on democratic practices that may be useful for Central Asian countries. Unlike India’s centralized model, elections in the U.S. are managed at the state level, allowing flexibility but also leading to inconsistencies between states. The U.S. employs various voting methods, including paper ballots and electronic systems, with an emphasis on local control. Many U.S. states offer mail-in (absentee) voting and early voting periods to make the electoral process more accessible to various segments of the population, including those who may have difficulty voting on Election Day due to work, health, or other reasons. These options aim to increase voter participation and accommodate diverse voter needs.

Implementing Best Practices in Central Asia

To successfully implement electoral reforms, countries in the region can leverage best practices from India and the U.S. Establishing independent electoral commissions can enhance trust and transparency. Integrating secure voting technologies can increase voter confidence. Introducing inclusivity measures, such as accessible polling stations and mail-in voting options, can broaden voter participation. Considering phased elections can help address logistical challenges. Introducing ethical codes can maintain integrity during elections.

Any adaptation of foreign practices must consider the unique cultural context of Central Asian countries. International models provide valuable frameworks, but they must be tailored to local conditions and traditions. Strengthening civil society organizations is crucial for supporting democratic reforms. These organizations can play an important role in informing voters about their rights and responsibilities, as well as monitoring electoral processes to ensure fairness.

Conclusion: The Way Forward

In this context, conducting political reforms in the region is challenging, although certain steps are being taken. For this reason, Central Asian countries may place greater emphasis on simplifying certain procedures, such as in the electoral sector, to increase citizen participation.

As Uzbekistan and other countries in the region continue their democratic transition, drawing lessons from established democracies like India and the U.S., they stand on the cusp of not only testing political reforms but also demonstrating a commitment to democratic principles on a global level. This could pave the way for a more inclusive and representative future based on transparency, accountability, and citizen participation — fundamental elements of a governance structure adapted to a unique cultural context — ensuring successful adaptation of foreign practices and fostering genuine competition, strengthening democracy in Central Asia and beyond.