BISHKEK (TCA) — Investors in Kyrgyzstan’s mining industry are facing three main problems — inconsistent fiscal policy, unjustified inspections by regulatory authorities and relations with the local population, Executive Director of the International Business Council (IBC) based in Bishkek, Askar Sydykov, said at a roundtable to discuss challenges of the mining industry’s regulatory framework.

For the first time, the Parliament’s Committee on Fuel and Energy Complex and Subsoil Use initiated a broad-based meeting with the business, and the IBC supported the idea to build an open dialogue useful for all stakeholders.

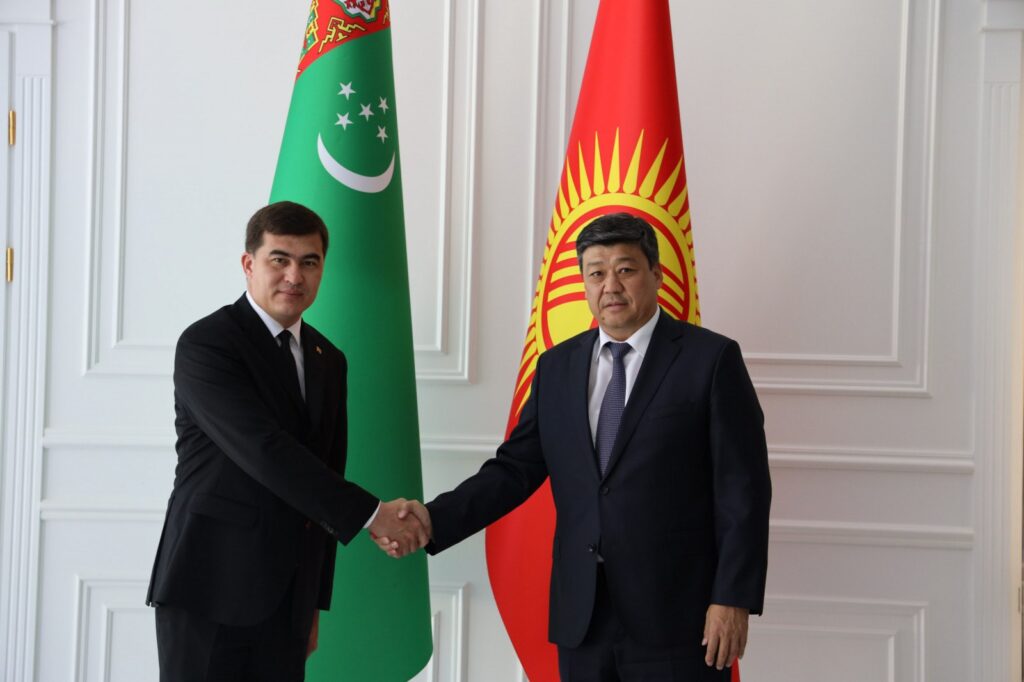

Committee head MP Kojobek Ryspaev and First Deputy Prime Minister Kubatbek Boronov listened to subsoil users, assuring that the Parliament and the Government were ready to support investors of the budget-forming industry.

“Over recent years, the Parliament has been developing normative legal acts aimed at creating favorable conditions for mining companies,” Ryspaev said, adding that he recognized the existence of problems in the industry. “Conflicts with the local population remain the main problem for us,” he said.

Pressure on businesses

According to the National Statistics Committee, foreign direct investments declined by 33.2% in the first half of the year.

“There are currently few investors in the mining industry due to the unpredictable legislation and poor protection of private property,” the IBC’s Askar Sydykov said.

According to the State Tax Service, in 2017, out of 256 court cases involving tax disputes, only 19 decisions were made in taxpayers’ favor.

Recently, several largest companies, including those with foreign participation, were involved in financial and criminal liability cases. The actions of law enforcement agencies were accompanied by violations of the fiscal and criminal legislation.

The situation is aggravated by the Procedure of distribution of funds reimbursed to the State by the law enforcement agencies. According to this document approved by the Government in June, certain percentage of funds reimbursed in favor of the State as a result of judicial acts in criminal cases initiated by law enforcement and supervisory authorities shall be transferred to the law enforcement agencies.

To obtain a designated percentage of funds, law enforcement agencies initiated and transferred to the judicial authorities cases against business people without sufficient legal grounds. It turned out that law enforcement agencies, using various power levers of influencing the business, “earn” bonuses. Having analyzed the accumulated total amount of the Single Deposit Account, experts concluded that a significant part was paid by businesses, but not corrupt ones.

Inconsistent state policy

According to the business, Kyrgyzstan’s subsoil use legislation contains many uncertain provisions and does not allow the subsoil users to make independent and effective decisions on production activities. The current legislation is burdensome for subsoil users who pay taxes not practiced in countries aimed at attracting foreign investment.

The current subsoil legislation is subject to frequent changes and the environmental one has a repressive bias, which creates a threat of bankruptcy of subsoil users or loss of business, which is a deterring factor for investors.

Since 2012, several innovations have been introduced into Kyrgyzstan’s legislation which had a negative impact on the mining enterprises. Moreover, government agencies are currently proposing new initiatives that would deteriorate the economic activities of subsoil users and could lead to their withdrawal from the Kyrgyz market.

The Kyrgyz Parliament proposes introducing of export customs duty on the export of ores and concentrates of precious metals. The Government discusses the expediency of increasing the tax rates on income for gold mining companies, as well as increasing bonuses (one-time payment for the right of subsoil use) and payments for license retention.

At the initiative of the IBC and the State Committee for Industry, Energy and Subsoil Use, from September 2017 to February 2018, the Ernst & Young international consulting company conducted a study on the overall contribution of gold mining to the economy of Kyrgyzstan and the possible impact of the above mentioned fiscal initiatives on it. The report was presented to the Prime Minister’s Office, the Parliament and the general public.

The results of the study showed that the desire to replenish the state budget by increasing the tax burden can only bring additional revenues for a very short period, but in the future it will have the opposite effect. Companies can move to richer and simpler deposits while other deposits will remain under-invested or unclaimed.

Meanwhile, mining could be carried out on those fields, benefiting the country and the local people.

However, the government ignored the results of the study.

Investors’ problems

After ten years of research and exploration works on the Chaarat gold field, the Chaarat Zaav CJSC has to proceed directly to its development. In October, special equipment was delivered for construction of a gold mining factory. The company planned to receive the first gold by the end of 2020.

“Unfortunately, in 2020 there will be no gold,” Alexander Novak, the company’s Board chairman said. The obstacle is the ban on the cutting of especially valuable tree species, including junipers. The law on the abolition of this ban was adopted in 2015, but the government’s decree on bringing it into force has not yet been adopted. The company is ready to compensate for damage in the case of cutting down junipers and start construction.

“We cannot start work and suffer heavy losses,” Novak said. According to forecasts, gold reserves of the Chaarat gold field are about 200 tons.

The meeting participants also raised the issue of VAT refunds, which is accumulated for the import of equipment. This practice exists in the country, but for some reason it does not work in relation to subsoil users. For instance, the refund for KAZ Minerals Bozymchak has amounted to $26 million.

In addition, the companies cannot use their waste for their own needs, including road filling and repair of bridges.

Stabilization regime

The roundtable discussed why the stabilization regime does not work in the country. The Law “On Investments” provides for the use of the stabilization regime by signing an agreement with the Government.

According to the business community, there are some flaws in its regulation. Provisions for subsoil users have not been spelled out. The Government Regulation implies a possible refusal of the state body to sign and return documents to investors, delaying the signing process.

Interaction with local population

Conflicts between subsoil users and the local population occur mainly due to the lack of balance between the interests of the State, investors and the local population, IBC believes. Discontent of the local population spilled over into acts of civil disobedience in several fields, and sometimes criminals were involved.

As a result of the confrontation of the local population, work at several fields is on the verge of stopping or has been suspended. The companies suffer losses, the local population remains without work, and the national budget does not receive taxes.

Local governments should conduct explanatory work with the population on the legislation and benefits from the activities of investors in the country and regions. To respect the interests of local communities, effective reforms have been carried out over the past few years including the transparency of the tender commission and additional deductions provided to local budgets in the form of social packages, funds from tenders and auctions, as well as payments for license retention. Local budgets receive 2% of the mining companies’ revenues, part of royalties, land tax, property tax, income tax, etc. But the local population often is not aware of it.

Business recommendations

The roundtable adopted a resolution on improving conditions for the activities of mining companies and the sustainable development of the industry.

Business recommended the Government to pursue a consistent state policy in subsoil use, including taking into account the results of the IBC study.

It is necessary to ease the stabilization regime for investors and make appropriate changes to the Tax Code.

The business recommended decriminalizing “entrepreneurial” offenses, choosing non-custodial measures for business people. It is necessary to consider alternative methods of stimulating the activities of law enforcement agencies not related to collecting money from private business entities.

To reduce conflicts with the local population, social investments and sustainable projects are needed to provide the population with jobs.