ASTANA (TCA) — The year 2017 was marked in Kazakhstan by the authorities’ efforts to lay the ground for a smooth state power succession and to overcome the country’s economic and financial problems accumulated in the recent years. We are republishing this article by George Voloshin on the issue, originally published by The Jamestown Foundation’s Eurasia Daily Monitor:

The year 2017 proved to be an eventful one for Kazakhstan, even as its long-time president, Nursultan Nazarbayev, who turned 77 last July, has yet to designate a potential successor to step into his shoes following the end of Nazarbayev’s more-than-25-year reign. The first part of the year was dominated by public discussions about constitutional reform (see EDM, February 23, 2017), which the president formally announced in December 2016, after having made several allusions to it in interviews to local and foreign journalists. While it was initially believed that the draft reform would be submitted to a popular referendum, the final decision ultimately went to the parliament. On March 6, 2017, both chambers voted in favor of sweeping legislative amendments that provide increased authority to the government and the legislature at the presidency’s expense.

Under the latest reform, the parliament is now the only source of new laws and no longer shares this prerogative with the executive—that is, all legislative initiatives must originate within the ranks of members of parliament (MP). Moreover, MPs may collectively ask the president to relieve cabinet ministers of their duties, if their professional or personal conduct is deemed illegal or unethical. Although the president retains the right to appoint the ministers of interior, foreign affairs and defense without prior consultations, all other appointments are to be made by the prime minister. The head of government is still appointed by the president, but the Constitution limits the choice to members of the ruling party, like in a classic parliamentary democracy. Last but not least, the government assumed full responsibility for socio-economic policy, with the presidency being, from here on out, legally prohibited from unilaterally adopting any decrees on these matters.

To date, not much has changed since the reforms were passed. President Nazarbayev still remains the only person in charge of all strategic decision-making, continues to dismiss and appoint members of the cabinet and other key officials, and holds the prime minister to a high standard of personal loyalty. The head of state’s ability to single-handedly influence government politics was made abundantly clear with the passage of major linguistic reform, which decrees the adoption of the Latin script, in lieu of the Cyrillic one, by 2022 (see EDM, April 25, 2017). Nazarbayev initiated the reform himself, through a newspaper article, in March 2017, underlining Kazakhstan’s desire to restore historical equity (the Latin alphabet was used in the country prior to World War II), modernize the economy and attract more foreigners to learning Kazakh. The new script was adopted in late October, having run a marathon of public hearings, parliamentary debates, ministerial meetings and multiple media appearances.

Another hot domestic issue, which again showed Nazarbayev in the captain’s seat, was the bailout of the second-largest bank, Kazkommertsbank (KKB). It was acquired for a symbolic one tenge (less than a third of a US dollar) by the largest financial institution in the country, Halyk Bank. Its owners are the president’s second daughter Dinara and her husband, Timur Kulibayev, both Forbes-list billionaires. KKB’s problems began in early 2009, when the global financial crisis hit the Kazakhstani banking sector hard. The Samruk Kazyna sovereign wealth fund partially bailed out KKB, whilst it simultaneously rescued from the brink of collapse three other banks: BTA, Alliance and Temir. BTA Bank, whose chairman Mukhtar Ablyazov, fled the country and became a vocal opponent to Nazarbayev, turned out to be a long-standing liability. KKB absorbed BTA in 2015, which only aggravated its own problems. As a result, faced with the prospect of losing KKB to market turbulence and a deeply troubled balance sheet, the government intervened by buying out the illiquid half of KKB’s assets and forcing Halyk to acquire the rest.

A new spike of banking-sector instability occurred in October–November 2017, when the ninth-largest bank by assets, RBK Bank, had to be bailed out amid unprecedented withdrawals of client money and the discovery of internal fraud. Kazakhstan’s Central Bank had earlier set aside a rescue package exceeding $1.5 billion, while total demand for government aid, a whole decade after the last crisis, is expected to reach new heights. However, public attention during this period was riveted to the unforeseen shortage of motor fuel, which angered tens of thousands of vehicle owners across the country (see EDM, November 16, 2017). A severe drop in fuel imports from Russia—due to strong demand in the Russian market, the shutdown of three refineries for maintenance and growing domestic consumption—all contributed to the massive deficit. The core of the problem lay in the fact that Kazakhstan had failed to modernize its oil refineries, despite this being a strategic national priority since at least 2009. This year should see Kazakhstan’s full self-sufficiency in gasoline and diesel supplies; but the Eurasian Economic Union (EEU), of which the country is a founding member, will not establish a common energy market before 2025.

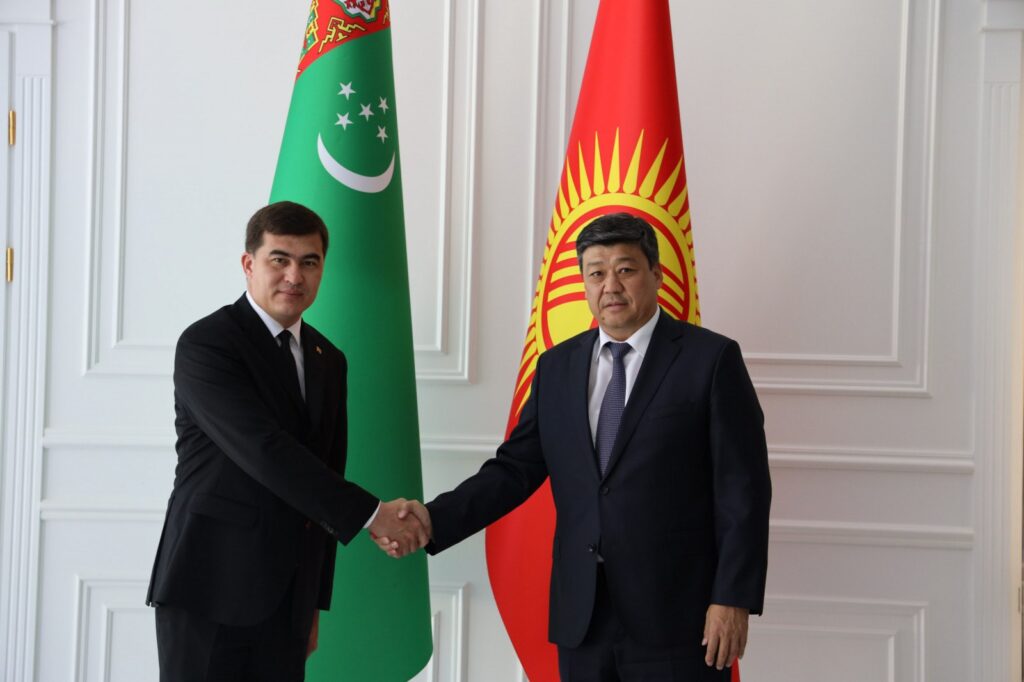

On the foreign policy front, the fragility of Eurasian integration at Russia’s behest came into light with a bitter dispute between Kazakhstan and Kyrgyzstan, following the outgoing Kyrgyzstani president’s disparaging remarks about Nazarbayev. Kazakhstan almost closed the border and drastically restricted the flow of people and goods, citing inadequate controls and security checks by its southern neighbor (see EDM, September 27, 2017; October 18, 2017). The situation subsequently resolved itself, to a point, after Nazarbayev met the newly elected leader of Kyrgyzstan and agreed to uphold friendly bilateral relations (see EDM, December 7, 2017). However, the rupture has yet to be fully patched up: the two countries have worked out a list of 50 measures to be implemented by Kyrgyzstan as part of its EEU membership. Like with many of Russia’s foreign policy initiatives, politics remains the dominant feature of trade integration in the former Soviet Union. Since economic rapprochement is based not on common parameters for deeper interdependence but on short-term geopolitical concerns, conflicts may flare up instantly, thus jeopardizing the very future of the EEU.

The month of December brought alarming news from New York, where BNY Mellon, acting as the custodian for the Central Bank of Kazakhstan, froze close to $22 billion worth of assets of Kazakhstan’s National Oil Fund (KazWorld, December 21, 2017). The decision came on the heels of several court orders in Europe to indemnify a Moldovan businessman, Anatolie Stati, for losses sustained in Kazakhstan during the early 2000s (Jurnal.md, January 18, 2017). Stati had won a $500 million award back in 2013, but it had not been honored by the Kazakhstani authorities. The government says the money is fully protected from seizure and will continue to earn income. Beyond the potential financial losses from the budget, the Stati affair could be a big hit to Kazakhstan’s investment attractiveness just as it tries to woo foreign investors to the brand-new Astana International Financial Center (AIFC). The new financial hub was launched last December and aims to transform Kazakhstan into a regional capital markets powerhouse (Inform.kz, December 6, 2017; Kazakhembus.com, accessed January 11, 2018). This year will be decisive for the success, or failure, of this key ambition of the Nazarbayev regime.