The escalating tensions between Afghanistan and Pakistan are forcing a reassessment of Afghanistan’s viability as a “partner space.” With cross-border clashes increasingly resembling a prolonged pattern rather than isolated incidents, and with both sides showing little willingness to compromise, the question grows more urgent: Can Afghanistan realistically become a partner for Central Asian countries, or is it destined to remain a persistent source of regional instability?

This confrontation is deeply unsettling for the countries of Central Asia. Still in the early stages of formulating coherent policies toward Afghanistan, they have tentatively linked their development strategies to the hope of having a stable neighbor to the south – one that might serve as a bridge to South Asia. Against this backdrop, deteriorating Afghan-Pakistani relations breed more frustration and anxiety than hope.

No country in the world, except Russia, has recognized the Taliban regime de jure. This broad reluctance reflects deep skepticism; few are willing to assume legal obligations or share responsibility for Kabul’s actions. Yet, Afghanistan remains far from isolated. Its geographic centrality makes it impossible to ignore.

Accordingly, Central Asia has developed a distinct approach to dealing with its southern neighbor. It can be summarized as: We do not recognize, but we cooperate; we do not trust, but we verify; we do not agree, but we engage.

In essence, Afghanistan’s neighbors, particularly the ones in Central Asia, have adopted a pragmatic, long-term strategy: engage without illusions or formal recognition, while maintaining the flexibility to adjust based on Kabul’s behavior.

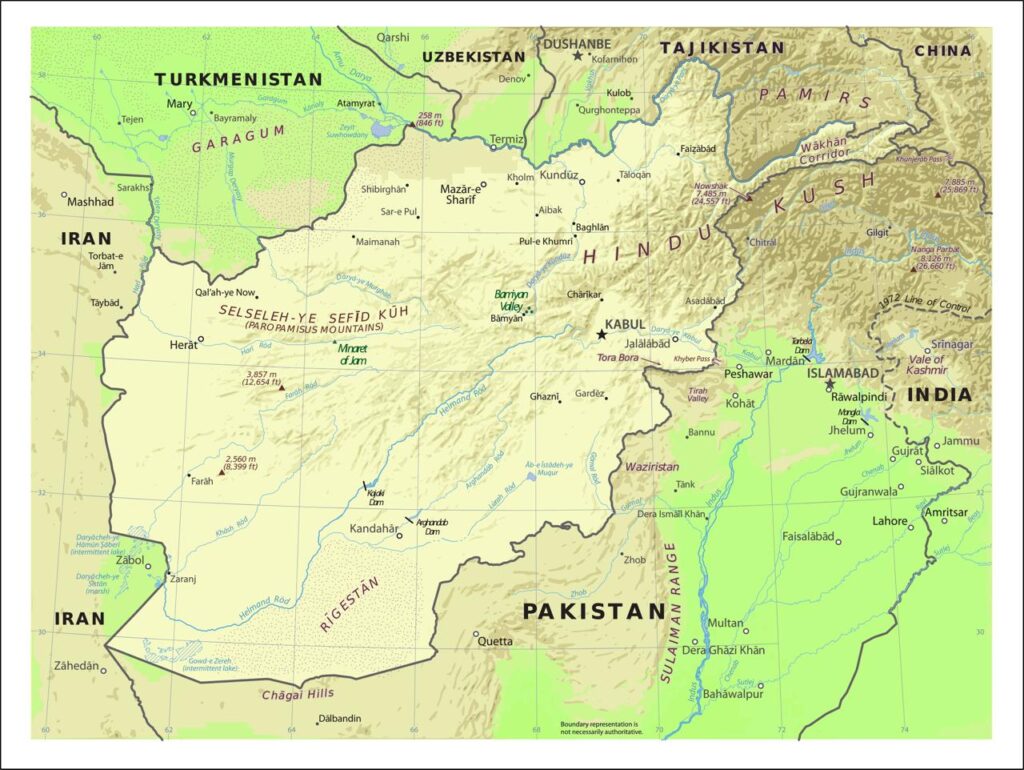

For these countries, Afghanistan does not stand as an independent priority. Its role is evaluated solely within the broader regional framework. In the most favorable scenario, Afghanistan serves as a transit corridor linking South and Central Asia. Yet even this utility is not indispensable; viable alternatives through Iran, the South Caucasus, Turkey, and China already exist and are expanding.

Looking ahead, three broad scenarios can be envisioned:

Optimistic: The Taliban demonstrate readiness for responsible engagement. This would enable Afghanistan’s gradual integration into trade and transport initiatives, expansion of economic ties, and a firm establishment as a bridge between Central and South Asia.

Pessimistic: Afghanistan remains a chronic risk factor and flashpoint for regional crises. The ongoing Afghan-Pakistani confrontation, no longer a fleeting episode but an entrenched conflict, is a clear warning sign. If this becomes the norm, it will deter serious investment, no stakeholder will commit to a country that cannot guarantee peace with its neighbors.

Inertia: Central Asian states continue their cautious balancing act under the logic that “a bad peace is better than a good war.” While cooperation continues at a minimal level, countries prioritize alternative routes and avoid deep commitments.

Under this status quo, ambitious projects like the Trans-Afghanistan Railway and the TAPI pipeline are unlikely to materialize. The former risks losing the “trans” prefix; the latter may, for now, become little more than a Turkmenistan-Afghanistan venture.

Nonetheless, there remains a window for diplomacy. Pressured by Turkey and Qatar, Kabul and Islamabad have agreed to resume negotiations aimed at a long-term de-escalation framework. This opens the door to a political resolution, and lowers the risk of irreversible rupture.

If Pakistan and Afghanistan seek regional stability, they have no choice but to move forward with mutual accommodation. Pakistan, unlike the Taliban-led emirate, is a full member of the international system and must continue engaging regional partners, including China, Iran, Russia, the countries of Central Asia, and the United Nations.

At the same time, the Taliban, in pursuit of international recognition, must show flexibility and a willingness to compromise. Their greatest risk is not just isolation, but irrelevance. Should regional powers shift decisively toward alternative transit corridors, Afghanistan may forfeit its only strategic asset, its geography. Rather than a bridge, it risks becoming a void on the regional map.

Progress in talks with Pakistan presents the Taliban with a chance to demonstrate that Afghanistan can act as a responsible stakeholder in regional security. If those negotiations transition into a formalized institutional process, it would mark a significant step forward, not just for Afghanistan and Pakistan, but for Eurasian connectivity as a whole.