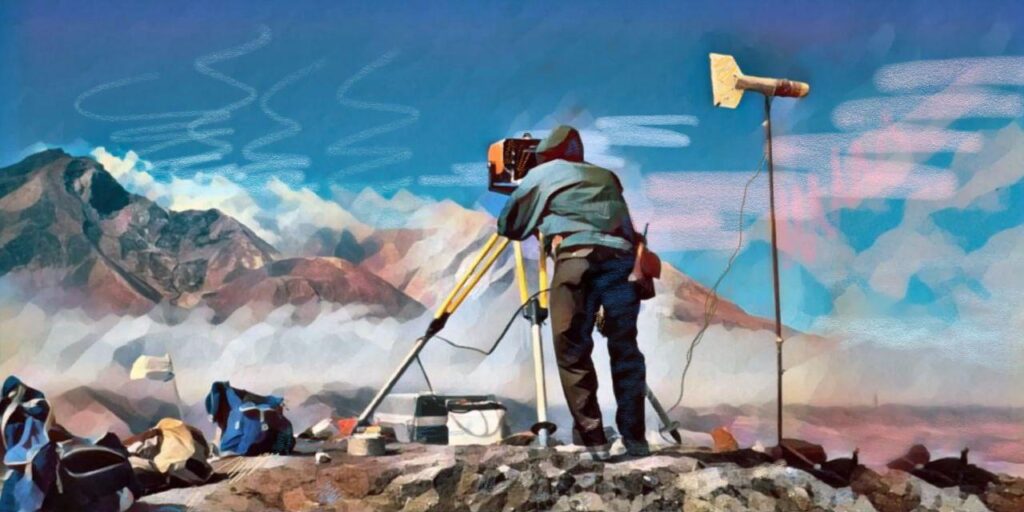

Kazakhstan is pushing a new phase of geological exploration, and the early results suggest that the country’s critical minerals profile is deepening. The Ministry of Industry and Construction says the area of mapped and studied subsoil will rise from about 2.1 to 2.2 million square kilometers by 2026. Exploration work completed in 2024 across eleven sites has produced new resource forecasts in Abai, East Kazakhstan, Karaganda, and Kostanay.

The distribution matters as much as the tonnages: rare earths and other strategic metals appear across multiple regions, while gold prospects stand out in Kostanay. Five deposits have been added to the national register, alongside newly booked reserves of gold, copper, manganese, and phosphorites. Kazakhstan’s mineral importance was already widely recognized; this round of findings measurably strengthens that judgment.

Four Regions Drive a Wider Metal Mix

The most recent round of results from the national survey program is notable for the geographic spread and metals mix. The 2024 work across eleven sites also produced new forecasts of precious, rare, and strategic metals in Abai, East Kazakhstan, Karaganda, and Kostanay, according to the Ministry of Industry and Construction.

In the Abai Region, geologists have outlined forecast resources of about 3,200 tonnes of beryllium, 1,100 tonnes of yttrium, and 200 tonnes of niobium. The mix points to advanced-manufacturing relevance, not a single-commodity profile. East Kazakhstan adds a second, larger beryllium signal, with newly identified deposits estimated at roughly 20,600 tonnes of beryllium and 600 tonnes of tungsten. That pairing reinforces an emerging pattern in which the northeast and east of the country are presenting not just rare-earth potential but a broader suite of strategic inputs.

The largest rare-earth figures in this announcement sit in the Karaganda Region. Early estimates there indicate roughly 935,400 tonnes of lanthanoids, alongside prospective resources of copper, yttrium, gallium, and molybdenum. This is consistent with the earlier 2025 reporting that has repeatedly placed central Kazakhstan at the center of the country’s renewed rare-earth narrative.

Kostanay Region stands out on the precious metals side. Forecast gold resources there are reported at about 17,500 tonnes, with prospective copper resources also identified. The December update also marks formal follow-through: five new deposits have been added to the national register, with newly booked reserves that include 98 tonnes of gold, 36,000 tonnes of copper, 11 million tons of manganese, and more than 1.3 million tonnes of phosphorites.

Taken together, these regionally distributed findings give added empirical weight to a view already present in earlier coverage: Kazakhstan’s mineral importance was established; the survey now suggests a widening and deepening strategic profile rather than a single episodic discovery.

Kazakhstan Treats Geological Knowledge as Policy

The December 8 update also fits a pattern visible through 2025: the state is treating geological knowledge as a policy tool. Earlier this year, the Geology Committee described plans to expand subsurface study coverage by early 2026, while late-2025 government reporting reiterated the 2.2 million square kilometer objective as a presidential instruction tied to industrial priorities.

What separates the current cycle from older, more episodic exploration is the combination of broad mapping and targeted studies. The specialized initiative in eastern Kazakhstan that examined collision-zone granitoids is an example of this deeper push. It identifies three target zones with substantial potential for niobium, zirconium, rare earths, molybdenum, and tungsten, with very large preliminary figures attached to each category.

The pattern suggests a planned survey design rather than chance. They reflect an intensifying survey architecture that is designed to widen the national resource map and to identify multi-metal clusters that may later support higher-value processing inside the country.

Forecasts, Early Estimates, and New Reserves Clarify the Stakes

The figures in the ministry’s summary combine several categories that sit at different stages of development. Some numbers are described as forecast resources, others as preliminary estimates tied to specific target zones, and still others as newly booked reserves added to the national register.

This distinction matters for readers who track Kazakhstan’s strategic position. Forecasts and early estimates signal geological promise and help shape investor interest, but they are not yet the same as proven, commercially bankable reserves. By contrast, the registry additions reported for 2024 reflect a more formal step in resource confirmation, including newly booked figures for gold, copper, manganese, and phosphorites.

For Kazakhstan, the policy-strategic effect is not only about export volume. It is also about the ability to turn a wider resource base into a more diversified industry. The government has repeatedly linked the survey expansion to industrialization aims and to a shift toward higher value-added production.

Recent reporting by The Times of Central Asia has framed rare earths and associated strategic metals as a category where the country can move from promising geology to a more competitive midstream role, provided that investment conditions, regulatory clarity, and technical capacity keep improving. The multi-region mix outlined on December 8 reinforces that perspective. Abai and East Kazakhstan point to a broader strategic-metals bundle. Karaganda anchors the rare-earth story with large early estimates. Kostanay adds a strong gold signal.

Strategic Outlook

Internationally, the latest survey results add another layer to Kazakhstan’s positioning as a potential non-Chinese source of critical materials, at a time when the United States, the European Union, and key Asian economies are all pursuing diversified supply arrangements. The country already holds a recognized place in the global uranium supply, and broader external interest in mineral cooperation with Central Asia has been building since 2025.

The December 8 announcement strengthens the investment case because it suggests scale across multiple regions rather than dependence on a single site. It also aligns with the 2025 trend of increasing exploration funding and more formal reserve registration.

The constraints remain familiar. Large tonnages on paper still require long lead times, capital-intensive feasibility work, and confidence in permitting and infrastructure. A reasonable near-term watch list, therefore, includes new tender announcements, joint-venture frameworks, and any concrete steps toward domestic refining or separation capacity that would turn geological promise into supply-chain leverage.