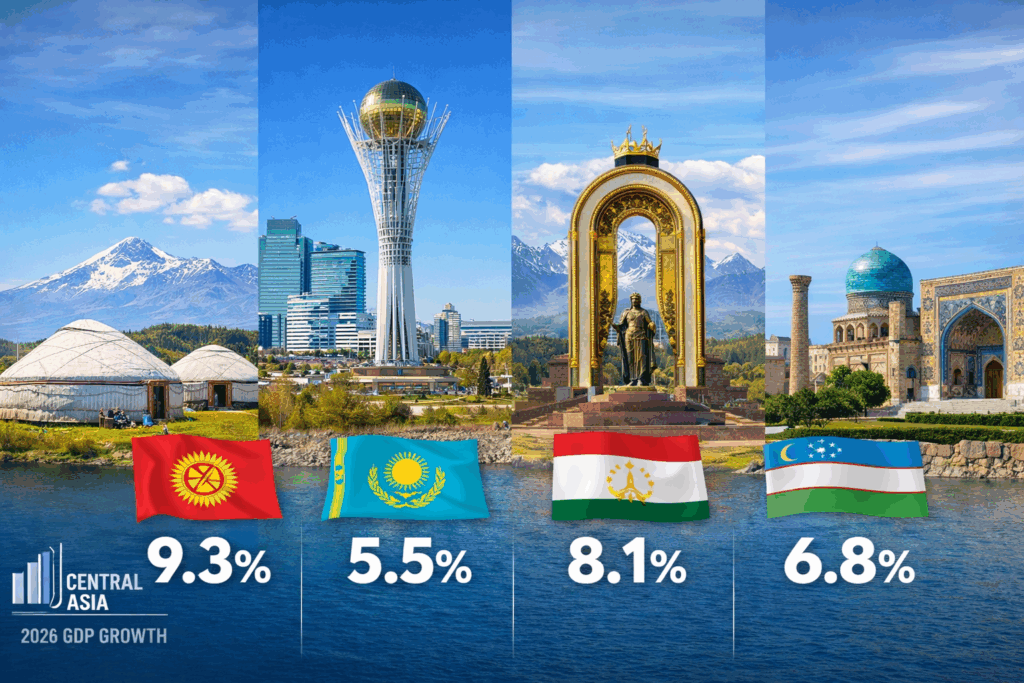

EDB Forecasts Strong Economic Growth in 2026 for Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan

On December 18, the Eurasian Development Bank (EDB) published its Macroeconomic Outlook for 2026-2028, reviewing recent economic developments and offering projections for its seven member states: Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, and Uzbekistan. According to the report, aggregate GDP growth across the EDB region is forecast to reach 2.3% in 2026. Kyrgyzstan (9.3%), Tajikistan (8.1%), Uzbekistan (6.8%), and Kazakhstan (5.5%) are expected to remain the region’s fastest-growing economies. After two years of rapid expansion, the region’s GDP growth is set to moderate to 1.9% in 2025, down from 4.5% in 2024, mainly due to a slowdown in Russia’s economy. Although lower oil prices are expected to reduce export revenues for energy exporters such as Kazakhstan and Russia, the impact on overall growth will be limited. Meanwhile, net oil importers, including Armenia, Belarus, Kyrgyzstan, Tajikistan, and Uzbekistan, will benefit from improved terms of trade and reduced inflationary pressure. High global gold prices will support foreign exchange earnings for key regional exporters, including Kyrgyzstan, Tajikistan, and Uzbekistan. The report also notes a gradual decline in the U.S. dollar’s share in central bank reserves across the region, though its role in international settlements remains stable. Kazakhstan Kazakhstan’s economy is projected to grow by 5.5% in 2026, supported by the implementation of the National Infrastructure Plan and the state program “Order for Investment,” which are expected to cushion the effects of lower oil prices. Growth in non-commodity exports will also play a stabilizing role. Inflation is forecast to decline to 9.7% by the end of 2026, after peaking early in the year due to a value-added tax (VAT) increase. The average tenge exchange rate is expected to be KZT 535 per U.S. dollar, underpinned by a high base interest rate and rising export revenues. Kyrgyzstan Kyrgyzstan is forecast to lead the region in GDP growth at 9.3% in 2026, driven by higher investment in transport, energy, water infrastructure, and housing construction. Inflation is expected to ease to 8.3%, although further declines will be constrained by higher tariffs and excise taxes. The average exchange rate is projected at KGS 89.2 per U.S. dollar, supported by robust remittance inflows and high global gold prices, gold being the country’s main export commodity. Tajikistan Tajikistan is projected to maintain high GDP growth of 8.1% in 2026, fueled by capacity expansion in the energy and manufacturing sectors, along with rising prices for gold and non-ferrous metals. Inflation is expected to reach 4.5% by year-end. The somoni is expected to remain stable, with an average exchange rate of TJS 9.8 per U.S. dollar, supported by growth in exports and remittances. Uzbekistan Uzbekistan’s economy is forecast to expand by 6.8% in 2026, sustained by strong investment activity and favorable gold prices. Inflation is projected to decline to 6.7%, helped by tight monetary policy and a stable exchange rate. The average soum exchange rate is expected to be UZS 12,800 per U.S. dollar, supported by high remittances and increased metal exports.

Japan Opens First Leaders-Level Summit With Central Asia

Japan hosted its first leaders-level summit with the five Central Asian republics on Friday, marking a diplomatic advance in a relationship that has existed for more than two decades but has rarely drawn wide attention. Prime Minister Sanae Takaichi opened the “Central Asia + Japan” summit in Tokyo, with discussions set to continue through December 20. The summit elevates a dialogue that until now has been conducted mainly at foreign ministers’ or senior diplomatic levels. Japan launched the original “Central Asia + Japan” initiative in 2004 to build cooperation with the Central Asian states through economic, educational, and political channels. In a bilateral meeting linked to the summit, Japanese Foreign Minister Toshimitsu Motegi met with his Tajik counterpart Sirojiddin Muhriddin, with the two sides agreeing on a cooperation program covering 2026–2028 and an investment treaty. These agreements represent the most concrete, publicly documented outcomes from the summit’s opening day and highlight Japan’s focus on strengthening bilateral ties alongside the broader multilateral dialogue. In parallel with the leaders’ meeting, Japan is hosting a “Central Asia + Japan” business forum organized by the Ministry of Economy, Trade and Industry to promote trade and private-sector cooperation. The leaders’ summit follows high-level bilateral diplomacy earlier in the week. On December 18, Prime Minister Takaichi met Kazakh President Kassym-Jomart Tokayev in Tokyo, where the two leaders signed a strategic partnership statement focused on energy, critical minerals, and expanded cooperation. Central Asia’s geopolitical significance has increased in recent years as its governments pursue multi-vector foreign policies aimed at broadening their external partnerships beyond traditional ties with Russia and China. Japan’s decision to elevate its dialogue with the region reflects this shift and Tokyo’s effort to remain an active partner amid growing engagement from the European Union, the United States, South Korea, and others. For Friday, the summit’s significance lies less in headline announcements than in its symbolism and early bilateral outcomes. The opening confirmed Japan’s intent to engage Central Asia at the highest political level, with broader commitments expected once the leaders conclude their talks and release a joint statement or action plan.

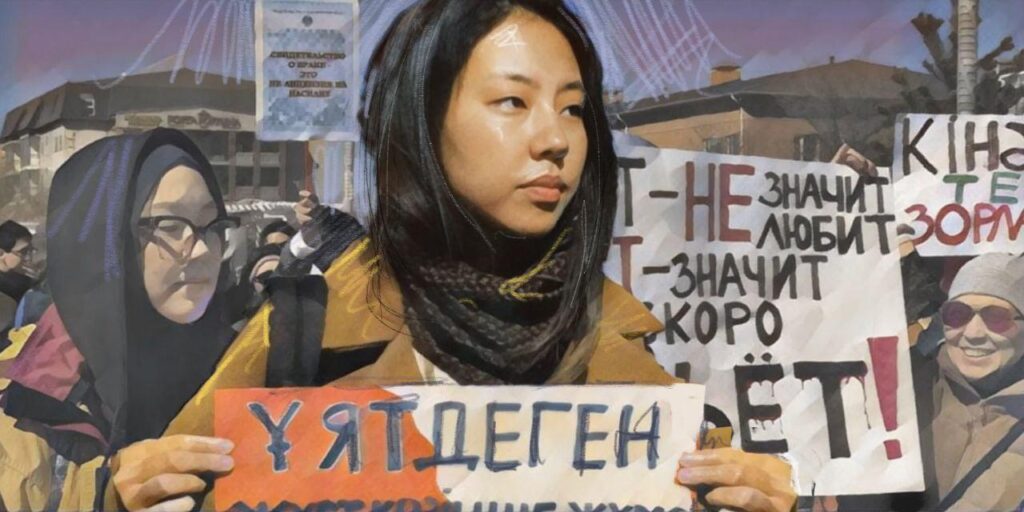

Pannier and Hillard’s Spotlight on Central Asia: New Episode Available Now

As Managing Editor of The Times of Central Asia, I’m delighted that, in partnership with the Oxus Society for Central Asian Affairs, from October 19, we are the home of the Spotlight on Central Asia podcast. Chaired by seasoned broadcasters Bruce Pannier of RFE/RL’s long-running Majlis podcast and Michael Hillard of The Red Line, each fortnightly instalment will take you on a deep dive into the latest news, developments, security issues, and social trends across an increasingly pivotal region. This week, we're unpacking Turkmenistan's Neutrality Summit, a rare moment where a string of big names quietly rolled into Ashgabat, and where the public messaging mattered just as much as the backroom deals. We'll also cut through the noise on the latest reporting from the Tajik–Afghan border, where misinformation is colliding with real security developments on the ground. From there, we'll take a hard look at the results of Kyrgyzstan's elections, what they actually tell us about where Bishkek is heading next, and what they don't, before examining the looming power rationing now shaping daily life and political pressure in two Central Asian states. And to wrap it up, we're joined by two outstanding experts for a frank conversation on gendered violence in Central Asia: what's changing, what isn't, and why the official statistics may only capture a fraction of the reality. On the show this week: Daryana Gryaznova (Equality Now) Svetlana Dzardanova (Human Rights and Corruption Researcher)

Japan Steps Out of the Shadows With First Central Asia Leaders’ Summit

On December 19-20, Tokyo will host a landmark summit poised to reshape Eurasian cooperation. For the first time in the 20-year history of the “Central Asia + Japan” format, the dialogue is being elevated to the level of heads of state. For Japan, this represents more than a diplomatic gesture; it signals a shift from what analysts often describe as cautious “silk diplomacy” to a more substantive political and economic partnership with a region increasingly central to global competition over resources and trade routes. The summit will be chaired by Japanese Prime Minister Sanae Takaichi. The leaders of all five Central Asian states, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, have confirmed their participation. Alongside the plenary session, bilateral meetings and a parallel business forum are scheduled to take place. Why Now? Established in 2004, the “Central Asia + Japan” format has largely functioned as a platform for foreign ministers and technical cooperation. According to Esbul Sartayev, assistant professor at the Center for Global Risks at Nagasaki University, raising the dialogue to the head-of-state level marks a deliberate step by Japan to abandon its traditionally “secondary” role in a region historically dominated by Russia and China. This shift comes amid a changing geopolitical context: disrupted global supply chains, intensifying competition for critical and rare earth resources, and a growing U.S. and EU presence in Central Asia. In this environment, Tokyo is promoting a coordinated approach to global order “based on the rule of law”, a neutral-sounding phrase with clear geopolitical resonance. Unlike other external actors in Central Asia, Japan has historically emphasized long-term development financing, technology transfer, and institutional capacity-building rather than security alliances or resource extraction. Japanese engagement has focused on infrastructure quality, human capital, and governance standards, allowing Tokyo to position itself as a complementary partner rather than a rival power in the region. Economy, Logistics, and AI The summit agenda encompasses a range of priorities: sustainable development, trade and investment expansion, infrastructure and logistics, and digital technology. Notably, the summit is expected to include a new framework for artificial intelligence cooperation aimed at strengthening economic security and supply chain development. It is also likely to reference expanded infrastructure cooperation, including transport routes linking Central Asia to Europe. As a resource-dependent country, Japan sees Central Asia as part of its evolving “resource and technological realism” strategy. For the Central Asian states, this presents a chance to integrate into new global value chains without being relegated to the role of raw material suppliers. Kazakhstan: Deals Worth Billions The summit coincides with Kazakh President Kassym-Jomart Tokayev’s official visit to Japan from December 18-20. During the visit, more than 40 agreements totaling over $3.7 billion are expected to be signed. These span energy, renewables, digitalization, mining, and transport. Participants include Samruk-Kazyna, KEGOC, Kazatomprom, KTZ, and major Japanese corporations such as Marubeni, Mitsubishi Heavy Industries, Toshiba, and JOGMEC. Japan’s ambassador to Kazakhstan, Yasumasa Iijima, has referred to Kazakhstan as a future Eurasian transport and logistics hub, highlighting its strategic role in developing the Trans-Caspian route and the Middle Corridor. Uzbekistan and the Wider Regional Stake In the past decade, Uzbekistan has significantly deepened its economic ties with Japan. Between 2017 and 2024, bilateral trade increased 2.3 times to $388.6 million, with a 64% surge recorded in 2024 alone. There are now 121 Japanese capital companies operating in the country, with cumulative Japanese investment and loans over this period reaching $184 million. Key areas of future cooperation include green transformation, digitalization, and human capital development. Kyrgyzstan views the C5+1 format as a tool to enhance its diplomatic leverage through regional solidarity. Its priorities include renewable energy, ecology, sustainable tourism, and educational exchanges. Tajikistan and Turkmenistan, meanwhile, are primarily interested in Japanese investment and technology in the energy sector. Geoeconomics Without Confrontation Although the summit is civilian in nature, its agenda also touches on security, ranging from stability in Afghanistan to climate and water-related risks. Analysts note that Japan is offering a model of engagement that avoids coercive political demands or military ambitions, instead emphasizing institutional partnerships, technological cooperation, and human resource development, an approach which has been described as "trust-building diplomacy.” More broadly, the Central Asia + Japan format enhances Central Asia’s agency, allowing the region to present a unified voice and reduce dependency on asymmetric relationships with great powers. For Tokyo, it is an opportunity to carve out a stable, long-term role in a region where geoeconomics increasingly outweighs geopolitics. For Central Asian governments, the shift to a leaders-level summit strengthens their collective bargaining position by reinforcing the region’s ability to engage external partners as a bloc. Speaking jointly allows the five states to elevate shared priorities such as transport connectivity, energy transition, and technology access, while limiting the risks of being drawn into bilateral dependencies with larger powers.

Tokayev Meets Emperor Naruhito Ahead of Landmark Japan–Central Asia Summit

President Kassym-Jomart Tokayev met Japan’s Emperor Naruhito in Tokyo on December 18, opening Kazakhstan’s first official presidential visit to Japan ahead of a landmark summit between Japan and all five Central Asian states. Japan’s imperial meetings are ceremonial, but they also signal political warmth and set the tone for high-level talks that follow. According to Nippon.com, Naruhito and Tokayev held a 20-minute meeting at the Imperial Palace before attending an hour-long luncheon with Crown Prince Akishino. The palace discussions included water issues, a long-standing focus of the emperor’s research and public work. Naruhito expressed sympathy over flooding in Kazakhstan last year – described by Tokayev as the “largest natural disaster in the last 80 years” - and raised concerns about water shortages linked to falling water levels in the Caspian Sea. Tokayev told the emperor that Kazakhstan is seeking a comprehensive United Nations approach to water problems. Tokayev’s Japan trip encompasses the first leaders-level “Central Asia + Japan” summit, scheduled for December 19–20 in Tokyo. The format began in 2004 and has operated through ministerial meetings and technical projects, so the move to the heads-of-state level marks a step-change. The summit - chaired by Japanese Prime Minister Sanae Takaichi - will bring together the leaders of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, with bilateral meetings and a business forum taking place on the sidelines. Japan’s government has been seeking stronger economic security and supply chain resilience, and Central Asia sits at the intersection of trade corridors, mineral resources, and infrastructure planning. Japan also plans to create a new framework for cooperation in artificial intelligence with the Central Asian states, using AI in mineral resource development and supply chain construction. This could be included in a joint leaders’ declaration, which is expected to mention infrastructure for transport routes connecting Central Asia and Europe via the Caspian Sea, backed by Japan’s official development assistance. Tokayev’s schedule includes meetings with Japanese business leaders, with major commercial deals tied to energy, renewables, digitalization, mining, and transport worth more than $3.7 billion expected to be finalized, according to Ruslan Zheldibay, press secretary to the Kazakh president. The optics are also important. Kazakhstan has long balanced relations with major powers, and Japan offers a different model of engagement from its larger neighbors. Tokyo’s outreach tends to focus on long-term financing, technology cooperation, and skills development rather than security blocs. That approach gives Central Asian governments another channel for investment and expertise, especially as they pursue energy transition projects and modernize transport routes such as the Middle Corridor. Tokayev’s meeting with Emperor Naruhito offers a high-profile opening to a visit that now moves into summit diplomacy and business negotiations. The Tokyo summit will test whether the upgraded Central Asia + Japan format can deliver concrete outcomes on technology, logistics, and investment, and whether Japan can translate symbolic moments into sustained influence in a region where trade routes and resources are again driving foreign policy.

Kazakh MP Sarym Proposes Legal Measures Over Social Media Posts on Pipeline Strike

A Kazakhstani lawmaker has proposed criminal liability for social media posts that express support for attacks on the country’s energy infrastructure. During a recent session of the Mazhilis (lower house of parliament), MP Aidos Sarym called for posts endorsing Ukrainian military strikes on oil infrastructure to be examined under existing laws on terrorism and high treason. The proposal follows a November 29 incident in which Ukraine’s armed forces reportedly targeted the Caspian Pipeline Consortium (CPC) terminal in Novorossiysk, Russia. The attack damaged the CPC’s VPU-2 offshore loading terminal and temporarily halted operations. Addressing Prosecutor General Berik Asylov and Deputy Prime Minister and Minister of Culture and Information Aida Balaeva, Sarym said the incident had sparked public commentary online that he believes exceeds the boundaries of protected speech. He called for investigations into such posts and suggested they may warrant legal action. “Such actions clearly go beyond the constitutional right to freedom of speech and directly harm national interests,” Sarym said, proposing that the government also launch an information campaign to discourage rhetoric supporting violence against critical infrastructure. The initiative coincides with broader debates in Kazakhstan over how to manage public discourse surrounding the war in Ukraine, amid concerns that expressions of support for either side could have diplomatic implications. Kazakhstan maintains relations with both Ukraine and Russia and has sought to preserve a neutral stance throughout the conflict. Sarym’s remarks were interpreted by some political analysts as a broader signal to members of parliament, following earlier comments by fellow deputy Yermurat Bapi. Bapi had previously characterized Ukrainian strikes on CPC facilities as part of a legitimate military strategy, a position that Sarym suggested could fall under legal review. Energy Minister Yerlan Akkenzhenov noted that approximately 80% of Kazakhstan’s oil exports transit through the CPC. While the pipeline includes Russian ownership, most shares belong to companies based in Kazakhstan, Europe, and the U.S., he said, countering claims that the CPC is solely a Russian asset. Kazakhstan is accelerating the repair of the VPU-2 terminal, now aiming for completion by January 2026. The Ministry of National Economy is currently assessing the economic impact of the disruption. Oil and gas analyst Olzhas Baidildinov estimated the production loss at 480,000 tons, equating to about $210 million in revenue over two weeks. He forecast monthly losses exceeding $400 million, including an estimated $150 million shortfall in budgetary revenue. Baidildinov expressed support for Sarym’s proposal, describing it as part of efforts to safeguard internal stability amid external geopolitical uncertainty. The proposal has not yet led to formal legislative action, and no prosecutions have been reported. Further discussion on the issue is expected as part of Kazakhstan’s broader approach to managing public discourse and national security in the context of the ongoing conflict between Russia and Ukraine.

The Digital Future of Central Asia: Who Is Shaping It, and How?

Digital security is now a key component of most processes in every country. A large share of organizations is moving, or has already moved, their processes online, which requires increased attention and control. Many Central Asian countries are already rolling out AI technologies at the state level. Financial institutions, social systems, crypto services, rental services, and other high-risk areas can no longer develop effectively without biometric identification and AI. Central Asia is gradually developing its own biometric landscape, and if we look at it not as a set of disparate projects but as an emerging infrastructure, it becomes clear that the countries are moving at very different speeds.

Kazakhstan: Leader in Biometrics and Digital Identity in the Region

Today, Kazakhstan is the undisputed leader in Central Asia in the field of biometric technologies. In this region biometrics has long gone beyond isolated pilots and has become part of the digital infrastructure on which a significant part of the economy operates. Unlike neighboring countries, where biometrics is most often limited to video surveillance or exclusively state initiatives, Kazakhstan has developed a mature market of independent developers and technology companies creating competitive products both for private organizations and for government platforms. Thanks to active digitalization, biometrics in the country has become not an add-on, but the primary mechanism for identity verification. The state additionally stimulates this process: it expands the use of biometric identification in ministerial processes, strengthens the requirements for remote verification, and transfers critical services, such as the issuance of an Electronic Digital Signature (EDS), to biometric authentication. In this way, an environment is being built in which online processes gain full legal validity and the population receives convenient access to services without the need to visit physical offices. Kazakhstan’s key distinction is that it has a full-fledged biometrics market, not just government-driven initiatives. The private sector actively invests in biometric solutions, integrates them into its processes, and competes on the quality of the user experience. Banks strive to reduce entry barriers for clients, MFIs (software development kits) increase protection against fraud, crypto exchanges strengthen their compliance structure, and marketplaces implement biometric identification to secure transactions. This has created an effect unique for the region: biometrics has ceased to be a one-off project and has turned into an everyday part of business. Against this background, independent local companies are developing that are capable of creating advanced technological solutions within the country. Among them, Biometric.Vision stands out in particular, an international company originating from Kazakhstan, one of the key players in the Kazakhstani market that has formed its own technological stack and operates across several industries. The company has become a technological partner for banks, financial organizations, government services, and regulated industries, providing software modules for remote identification, biometric verification, liveness checks, and fraud prevention. Local products make it possible to respond quickly to new regulatory requirements, adapt to them, and address the real needs of local businesses. For Kazakhstan, the presence of local players in the biometrics market is an important strategic advantage, since many Central Asian countries are dependent on external providers. In this region biometrics has become not just a local product, but a full-fledged element of digital sovereignty, thanks to which the country can control high-risk identity infrastructure without relying on external providers. Therefore, biometrics in Kazakhstan has become not just a technological tool, but the foundation of trust between the state, business, and citizens. The presence of independent developers, mature demand from businesses, and active state support is turning the country into the most dynamically developing biometrics market in the region, and it is here that the model is being formed which other Central Asian countries will adopt in the coming years.Kyrgyzstan: State-Led Development of Biometric Systems

By contrast, neighboring Kyrgyzstan looks very different. While in Kazakhstan biometrics has long since also become a private business tool, in Kyrgyzstan it remains primarily an element of state security systems and document management. The most advanced area here is biometric passports, which have provided enhanced security compared to the ordinary ones since 2021. Such passports comply with ICAO international protection standards. This is a significant step forward that confirms the technological ambitions of the state, but the introduction of digitalization into the processes of private players is severely limited. Another notable segment is video surveillance and access control systems, where solutions with facial recognition are being actively implemented. However, all of this is essentially security infrastructure, not a digital identity ecosystem capable of serving such financial institutions as banks, MFIs, pawnshops, and, in general, any private business sectors and organizations. In Kyrgyzstan there are still no independent local companies that could offer a full-fledged e-KYC module, provide an SDK, API, a remote identification platform, and take on the legal validity of the process. The commercial biometrics market has in fact not been formed, and businesses that require remote customer identification either rely on external solutions or are forced to make do with simpler mechanisms. The development of biometric passports depended on the German company Mühlbauer and the American company Entrust. The state enterprise Infocom was only responsible for the overall coordination of the project. Private players are even more constrained and are forced to turn to imported solutions from India (Accurascan), which greatly complicates control over the process, adaptation to local regulatory requirements, and the overall development of local technologies in the region. In terms of the depth of technologies and integration with the digital economy, Kyrgyzstan is noticeably lagging behind Kazakhstan, although in terms of the level of implementation of video surveillance and government documents it is making significant strides, yet it still heavily depends on foreign players.Tajikistan: Biometrics Without a Market

Tajikistan is at an even earlier stage of development. Here biometrics appears in a fragmented way and mainly through external integrators that, as security measures, install video surveillance cameras, access terminals, or equipment from foreign manufacturers. The most active players in the market remain companies like Sarfaroz, which work with security systems, access control, and video surveillance, but do not develop solutions for remote identity verification. Tajikistan so far does not have a single independent local player capable of offering the market local e-KYC technologies, and the digital identification of citizens remains a domain dominated by the state. An example of this was the recent decision by the state to move retirees to digital identification. The State Agency for Social Protection has begun implementing mandatory registration through a mobile application, facial recognition, and photographing of documents. This is a major step in digitalization, affecting a large and vulnerable segment of the population. However, the implementation of this project once again highlights the specifics of the Tajik market: the technology contractor is not named, no private developer is visible, and all digital identification is precisely a state mechanism rather than a product created by an independent local company. In Tajikistan biometrics is developing from the top down, through government contracts and a narrowly focused security infrastructure, rather than through a private market of technological solutions. The absence of independent local e-KYC developers makes the market one-sided: all significant projects, from video surveillance systems to new mechanisms of digital identification of citizens, are tied to government agencies and integrators working with imported equipment. This limits the flexibility of implementations and slows down the pace of innovation. The country effectively remains in a situation where biometric technologies are applied only where they are initiated by the state, while the private sector has neither the tools nor the capabilities for the independent development of digital identity.The Future of Digital Identity in Central Asia

Central Asia is gradually entering a stage of digital transformation, where biometrics is becoming one of the key elements of the future socio-economic model. The field of digital identity is shaping a new level of interaction between the state, business, and citizens. Despite a noticeable difference in pace, the countries of the region are moving in the same direction, toward creating a sustainable and secure digital environment that will determine their competitiveness in the coming years. The future success of Central Asia in the field of digital identity will depend on the ability of the countries to build their own technological competencies, modernize the regulatory environment, and create conditions for the development of local innovative companies. If these factors align, the entire region will be able to move from being a consumer of technology to becoming a creator, forming a space in which biometrics will become not just a means of identification, but a platform for a new digital economy.Bishkek to Host Second B5+1 Forum of Central Asia and the U.S.

Kyrgyzstan is preparing to host the second B5+1 Forum of Central Asia and the United States, scheduled for February 4-5, 2026, in Bishkek. On December 12, Kyrgyzstan’s Ministry of Foreign Affairs and Ministry of Economy and Commerce held a joint briefing for ambassadors from Central Asian countries and the United States to outline preparations for the event. The B5+1 platform serves as the business counterpart to the C5+1 diplomatic initiative, which unites the five countries of Central Asia – Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan – with the United States. Launched by the Center for International Private Enterprise (CIPE) under its Improving the Business Environment in Central Asia (IBECA) program, B5+1 is supported by the U.S. Department of State and aims to foster high-level engagement between business leaders and policymakers. The upcoming forum in Bishkek builds on the outcomes of the C5+1 Summit held in Washington on November 6 this year. Its objective is to deepen U.S.-Central Asia economic cooperation and highlight the private sector’s pivotal role in advancing economic reform across the region. The event is co-hosted by CIPE and the Kyrgyz government. According to organizers, the forum’s agenda will focus on key sectors including agriculture, e-commerce, information technology, transport and logistics, tourism, banking, and critical minerals. These thematic areas reflect emerging regional priorities and shared interests in enhancing sustainable growth and economic resilience. The B5+1 Forum aims to create a platform for sustained dialogue between governments and private sector actors, encouraging the development of long-term partnerships and policy coordination. The inaugural B5+1 Forum was held in Almaty in March 2024, and brought together over 250 stakeholders from all five Central Asian countries and the United States. The first event centered on regional cooperation and connectivity, with a strong emphasis on empowering the private sector to support the objectives of the C5+1 Economic and Energy Corridors.

Sunkar Podcast

Central Asia and the Troubled Southern Route