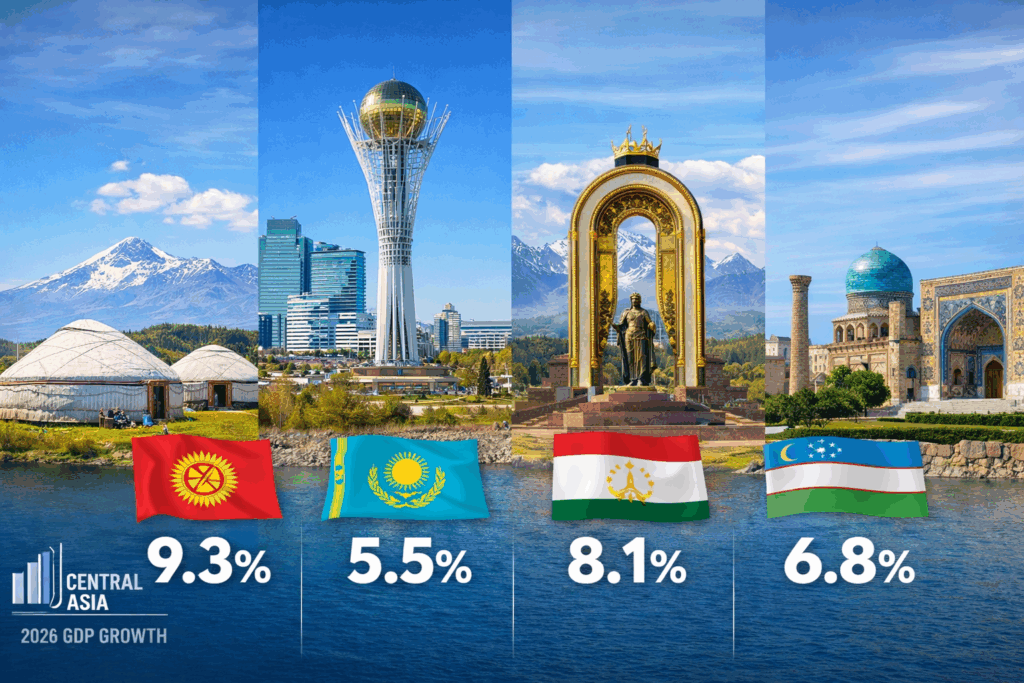

EDB Forecasts Strong Economic Growth in 2026 for Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan

On December 18, the Eurasian Development Bank (EDB) published its Macroeconomic Outlook for 2026-2028, reviewing recent economic developments and offering projections for its seven member states: Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, and Uzbekistan. According to the report, aggregate GDP growth across the EDB region is forecast to reach 2.3% in 2026. Kyrgyzstan (9.3%), Tajikistan (8.1%), Uzbekistan (6.8%), and Kazakhstan (5.5%) are expected to remain the region’s fastest-growing economies. After two years of rapid expansion, the region’s GDP growth is set to moderate to 1.9% in 2025, down from 4.5% in 2024, mainly due to a slowdown in Russia’s economy. Although lower oil prices are expected to reduce export revenues for energy exporters such as Kazakhstan and Russia, the impact on overall growth will be limited. Meanwhile, net oil importers, including Armenia, Belarus, Kyrgyzstan, Tajikistan, and Uzbekistan, will benefit from improved terms of trade and reduced inflationary pressure. High global gold prices will support foreign exchange earnings for key regional exporters, including Kyrgyzstan, Tajikistan, and Uzbekistan. The report also notes a gradual decline in the U.S. dollar’s share in central bank reserves across the region, though its role in international settlements remains stable. Kazakhstan Kazakhstan’s economy is projected to grow by 5.5% in 2026, supported by the implementation of the National Infrastructure Plan and the state program “Order for Investment,” which are expected to cushion the effects of lower oil prices. Growth in non-commodity exports will also play a stabilizing role. Inflation is forecast to decline to 9.7% by the end of 2026, after peaking early in the year due to a value-added tax (VAT) increase. The average tenge exchange rate is expected to be KZT 535 per U.S. dollar, underpinned by a high base interest rate and rising export revenues. Kyrgyzstan Kyrgyzstan is forecast to lead the region in GDP growth at 9.3% in 2026, driven by higher investment in transport, energy, water infrastructure, and housing construction. Inflation is expected to ease to 8.3%, although further declines will be constrained by higher tariffs and excise taxes. The average exchange rate is projected at KGS 89.2 per U.S. dollar, supported by robust remittance inflows and high global gold prices, gold being the country’s main export commodity. Tajikistan Tajikistan is projected to maintain high GDP growth of 8.1% in 2026, fueled by capacity expansion in the energy and manufacturing sectors, along with rising prices for gold and non-ferrous metals. Inflation is expected to reach 4.5% by year-end. The somoni is expected to remain stable, with an average exchange rate of TJS 9.8 per U.S. dollar, supported by growth in exports and remittances. Uzbekistan Uzbekistan’s economy is forecast to expand by 6.8% in 2026, sustained by strong investment activity and favorable gold prices. Inflation is projected to decline to 6.7%, helped by tight monetary policy and a stable exchange rate. The average soum exchange rate is expected to be UZS 12,800 per U.S. dollar, supported by high remittances and increased metal exports.

Japan Opens First Leaders-Level Summit With Central Asia

Japan hosted its first leaders-level summit with the five Central Asian republics on Friday, marking a diplomatic advance in a relationship that has existed for more than two decades but has rarely drawn wide attention. Prime Minister Sanae Takaichi opened the “Central Asia + Japan” summit in Tokyo, with discussions set to continue through December 20. The summit elevates a dialogue that until now has been conducted mainly at foreign ministers’ or senior diplomatic levels. Japan launched the original “Central Asia + Japan” initiative in 2004 to build cooperation with the Central Asian states through economic, educational, and political channels. In a bilateral meeting linked to the summit, Japanese Foreign Minister Toshimitsu Motegi met with his Tajik counterpart Sirojiddin Muhriddin, with the two sides agreeing on a cooperation program covering 2026–2028 and an investment treaty. These agreements represent the most concrete, publicly documented outcomes from the summit’s opening day and highlight Japan’s focus on strengthening bilateral ties alongside the broader multilateral dialogue. In parallel with the leaders’ meeting, Japan is hosting a “Central Asia + Japan” business forum organized by the Ministry of Economy, Trade and Industry to promote trade and private-sector cooperation. The leaders’ summit follows high-level bilateral diplomacy earlier in the week. On December 18, Prime Minister Takaichi met Kazakh President Kassym-Jomart Tokayev in Tokyo, where the two leaders signed a strategic partnership statement focused on energy, critical minerals, and expanded cooperation. Central Asia’s geopolitical significance has increased in recent years as its governments pursue multi-vector foreign policies aimed at broadening their external partnerships beyond traditional ties with Russia and China. Japan’s decision to elevate its dialogue with the region reflects this shift and Tokyo’s effort to remain an active partner amid growing engagement from the European Union, the United States, South Korea, and others. For Friday, the summit’s significance lies less in headline announcements than in its symbolism and early bilateral outcomes. The opening confirmed Japan’s intent to engage Central Asia at the highest political level, with broader commitments expected once the leaders conclude their talks and release a joint statement or action plan.

Pannier and Hillard’s Spotlight on Central Asia: New Episode Available Now

As Managing Editor of The Times of Central Asia, I’m delighted that, in partnership with the Oxus Society for Central Asian Affairs, from October 19, we are the home of the Spotlight on Central Asia podcast. Chaired by seasoned broadcasters Bruce Pannier of RFE/RL’s long-running Majlis podcast and Michael Hillard of The Red Line, each fortnightly instalment will take you on a deep dive into the latest news, developments, security issues, and social trends across an increasingly pivotal region. This week, we're unpacking Turkmenistan's Neutrality Summit, a rare moment where a string of big names quietly rolled into Ashgabat, and where the public messaging mattered just as much as the backroom deals. We'll also cut through the noise on the latest reporting from the Tajik–Afghan border, where misinformation is colliding with real security developments on the ground. From there, we'll take a hard look at the results of Kyrgyzstan's elections, what they actually tell us about where Bishkek is heading next, and what they don't, before examining the looming power rationing now shaping daily life and political pressure in two Central Asian states. And to wrap it up, we're joined by two outstanding experts for a frank conversation on gendered violence in Central Asia: what's changing, what isn't, and why the official statistics may only capture a fraction of the reality. On the show this week: Daryana Gryaznova (Equality Now) Svetlana Dzardanova (Human Rights and Corruption Researcher)

Japan Steps Out of the Shadows With First Central Asia Leaders’ Summit

On December 19-20, Tokyo will host a landmark summit poised to reshape Eurasian cooperation. For the first time in the 20-year history of the “Central Asia + Japan” format, the dialogue is being elevated to the level of heads of state. For Japan, this represents more than a diplomatic gesture; it signals a shift from what analysts often describe as cautious “silk diplomacy” to a more substantive political and economic partnership with a region increasingly central to global competition over resources and trade routes. The summit will be chaired by Japanese Prime Minister Sanae Takaichi. The leaders of all five Central Asian states, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, have confirmed their participation. Alongside the plenary session, bilateral meetings and a parallel business forum are scheduled to take place. Why Now? Established in 2004, the “Central Asia + Japan” format has largely functioned as a platform for foreign ministers and technical cooperation. According to Esbul Sartayev, assistant professor at the Center for Global Risks at Nagasaki University, raising the dialogue to the head-of-state level marks a deliberate step by Japan to abandon its traditionally “secondary” role in a region historically dominated by Russia and China. This shift comes amid a changing geopolitical context: disrupted global supply chains, intensifying competition for critical and rare earth resources, and a growing U.S. and EU presence in Central Asia. In this environment, Tokyo is promoting a coordinated approach to global order “based on the rule of law”, a neutral-sounding phrase with clear geopolitical resonance. Unlike other external actors in Central Asia, Japan has historically emphasized long-term development financing, technology transfer, and institutional capacity-building rather than security alliances or resource extraction. Japanese engagement has focused on infrastructure quality, human capital, and governance standards, allowing Tokyo to position itself as a complementary partner rather than a rival power in the region. Economy, Logistics, and AI The summit agenda encompasses a range of priorities: sustainable development, trade and investment expansion, infrastructure and logistics, and digital technology. Notably, the summit is expected to include a new framework for artificial intelligence cooperation aimed at strengthening economic security and supply chain development. It is also likely to reference expanded infrastructure cooperation, including transport routes linking Central Asia to Europe. As a resource-dependent country, Japan sees Central Asia as part of its evolving “resource and technological realism” strategy. For the Central Asian states, this presents a chance to integrate into new global value chains without being relegated to the role of raw material suppliers. Kazakhstan: Deals Worth Billions The summit coincides with Kazakh President Kassym-Jomart Tokayev’s official visit to Japan from December 18-20. During the visit, more than 40 agreements totaling over $3.7 billion are expected to be signed. These span energy, renewables, digitalization, mining, and transport. Participants include Samruk-Kazyna, KEGOC, Kazatomprom, KTZ, and major Japanese corporations such as Marubeni, Mitsubishi Heavy Industries, Toshiba, and JOGMEC. Japan’s ambassador to Kazakhstan, Yasumasa Iijima, has referred to Kazakhstan as a future Eurasian transport and logistics hub, highlighting its strategic role in developing the Trans-Caspian route and the Middle Corridor. Uzbekistan and the Wider Regional Stake In the past decade, Uzbekistan has significantly deepened its economic ties with Japan. Between 2017 and 2024, bilateral trade increased 2.3 times to $388.6 million, with a 64% surge recorded in 2024 alone. There are now 121 Japanese capital companies operating in the country, with cumulative Japanese investment and loans over this period reaching $184 million. Key areas of future cooperation include green transformation, digitalization, and human capital development. Kyrgyzstan views the C5+1 format as a tool to enhance its diplomatic leverage through regional solidarity. Its priorities include renewable energy, ecology, sustainable tourism, and educational exchanges. Tajikistan and Turkmenistan, meanwhile, are primarily interested in Japanese investment and technology in the energy sector. Geoeconomics Without Confrontation Although the summit is civilian in nature, its agenda also touches on security, ranging from stability in Afghanistan to climate and water-related risks. Analysts note that Japan is offering a model of engagement that avoids coercive political demands or military ambitions, instead emphasizing institutional partnerships, technological cooperation, and human resource development, an approach which has been described as "trust-building diplomacy.” More broadly, the Central Asia + Japan format enhances Central Asia’s agency, allowing the region to present a unified voice and reduce dependency on asymmetric relationships with great powers. For Tokyo, it is an opportunity to carve out a stable, long-term role in a region where geoeconomics increasingly outweighs geopolitics. For Central Asian governments, the shift to a leaders-level summit strengthens their collective bargaining position by reinforcing the region’s ability to engage external partners as a bloc. Speaking jointly allows the five states to elevate shared priorities such as transport connectivity, energy transition, and technology access, while limiting the risks of being drawn into bilateral dependencies with larger powers.

Bishkek to Host Second B5+1 Forum of Central Asia and the U.S.

Kyrgyzstan is preparing to host the second B5+1 Forum of Central Asia and the United States, scheduled for February 4-5, 2026, in Bishkek. On December 12, Kyrgyzstan’s Ministry of Foreign Affairs and Ministry of Economy and Commerce held a joint briefing for ambassadors from Central Asian countries and the United States to outline preparations for the event. The B5+1 platform serves as the business counterpart to the C5+1 diplomatic initiative, which unites the five countries of Central Asia – Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan – with the United States. Launched by the Center for International Private Enterprise (CIPE) under its Improving the Business Environment in Central Asia (IBECA) program, B5+1 is supported by the U.S. Department of State and aims to foster high-level engagement between business leaders and policymakers. The upcoming forum in Bishkek builds on the outcomes of the C5+1 Summit held in Washington on November 6 this year. Its objective is to deepen U.S.-Central Asia economic cooperation and highlight the private sector’s pivotal role in advancing economic reform across the region. The event is co-hosted by CIPE and the Kyrgyz government. According to organizers, the forum’s agenda will focus on key sectors including agriculture, e-commerce, information technology, transport and logistics, tourism, banking, and critical minerals. These thematic areas reflect emerging regional priorities and shared interests in enhancing sustainable growth and economic resilience. The B5+1 Forum aims to create a platform for sustained dialogue between governments and private sector actors, encouraging the development of long-term partnerships and policy coordination. The inaugural B5+1 Forum was held in Almaty in March 2024, and brought together over 250 stakeholders from all five Central Asian countries and the United States. The first event centered on regional cooperation and connectivity, with a strong emphasis on empowering the private sector to support the objectives of the C5+1 Economic and Energy Corridors.

Glacier Melt Threatens Central Asia’s Water Security, Experts Warn at Regional Forum

The accelerating retreat of glaciers poses a serious risk to water security across Central and West Asia, scientists and journalists warned during an online media forum jointly hosted by the Asian Development Bank (ADB) and the International Centre for Integrated Mountain Development (ICIMOD) on December 10, according to Asia-Plus. The forum focused on the growing impact of glacial melt in mountain regions, including the Pamirs, Tien Shan, Hindu Kush, and Himalayas, where shrinking ice reserves are increasingly disrupting water supplies for agriculture, energy, and drinking water. A key highlight was the ADB’s Glacier to Farms (G2F) program, presented by senior climate adaptation specialist Chris Dickinson. The initiative, spanning nine countries including Tajikistan, Uzbekistan, Armenia, and Georgia, aims to link glacier monitoring with practical, climate-resilient policy measures. Unlike past approaches that primarily diagnosed the problem, G2F offers technical and financial solutions designed to support communities in adapting to climate change. The $3.5 billion initiative, backed in part by $250 million from the Green Climate Fund, leverages a co-financing model that aims to attract $10 in additional investment for every dollar committed. The program envisions a full climate adaptation chain from satellite-based glacier monitoring and mountain observation stations to downstream interventions such as crop insurance, farmer support, and modernization of water infrastructure. “Glaciers are the origin of the entire food and water system,” Dickinson said. “Their rapid retreat threatens lives and livelihoods far beyond mountain regions.” Tajikistan serves as a pilot site for the program due to its heavy reliance on hydropower and its largely mountainous terrain. One of the project's key goals is to enhance the country’s hydrometeorological services and strengthen monitoring of snow cover, glacier movement, landslides, and related hazards. A modern early warning system is being developed for the Panj River basin, combining data on glacial lakes, mudflows, precipitation, and seismic activity. The alerts will be sent to vulnerable communities via mobile networks, complemented by local training programs to ensure proper responses. Forum participants noted that the effects of glacial retreat are already evident. Glaciers in the Tien Shan and Pamir ranges feed the Amu Darya and Syr Darya rivers, vital water sources for Central Asia’s agriculture, energy, and drinking needs. An estimated 74% of the Amu Darya’s flow comes from snow and glacier melt. In the Indus basin, the figure is about 40%. Yet only a small number of the region’s more than 54,000 glaciers are regularly monitored, leaving gaps in early warning systems and long-term planning. Experts from ICIMOD and ADB described glacier melt as a “cascading crisis.” Rising temperatures are fueling more frequent landslides, floods, and mudflows, while droughts reduce crop yields and damage pastures. Glacial lake outburst floods, sudden and destructive releases of water, pose grave risks to nearby settlements. Since the 19th century, the region has recorded around 500 such incidents, and their frequency could triple by the end of this century. Heatwaves and water quality issues further compound the risks. Recent glacial activity in Tajikistan underscored the forum’s urgency. In October, a massive segment of a glacier broke off Mount Ismoil Somoni in the Tajikabad district, near the village of Safedobi. The ice mass measured approximately two kilometers in length, up to 25 meters in height, and between 150 and 200 meters wide. It slid into a gorge, but emergency services quickly stabilized the situation, with no casualties reported. In a separate incident, a large portion of the Didal Glacier in the same district detached and slid more than five kilometers downslope. Experts from Tajikistan’s Center for Glaciology reported that the ice continued to shift for several days and remained unstable. Field teams measuring the glacier in the Surkhob River basin found it to be 1.5 kilometers long, 200 meters wide, and up to 50 meters high. Research shared by ICIMOD and Norway’s Water Resources and Energy Directorate revealed that Central Asia accounts for roughly 8.5% of global glacier mass loss, one of the highest regional shares worldwide. Miriam Jackson, an ICIMOD representative, warned that if global temperatures rise by 1.9°C, the region could lose up to 50% of its glaciers, significantly worsening pressure on already strained water supplies.

Tajikistan’s Forests on the Brink of Extinction

Tajikistan's forests, already scarce, covering just 3% of the country's territory, are facing unprecedented threats due to climate change and human activity. These fragile ecosystems, vital for maintaining the country’s ecological balance, are rapidly disappearing, with far-reaching consequences for the environment and public safety. Since the early 1990s, Tajikistan’s forest area has shrunk significantly. Currently, forests cover approximately 423,000 hectares, compared to about 20% of the national territory a century ago. In the 19th century, tugai forests alone spanned one million hectares, now reduced more than eightfold. The causes of deforestation are complex: widespread logging during past energy crises, land conversion for agriculture, rising temperatures, and declining precipitation. These factors have accelerated ecosystem degradation and disrupted the country’s water balance. Forest loss is also directly linked to the rising frequency of natural disasters. According to the National Climate Report, the number of mudslides and landslides has increased by 25-30% over the past two decades. Experts estimate that one in five landslides in mountainous regions is directly related to deforestation. Climate warming is also hastening snow and glacier melt, resulting in sudden floods, while prolonged droughts render the soil brittle and unstable. Forests once served as a natural buffer against these effects, but are no longer able to perform this function effectively. As temperatures rise, Tajikistan’s forests are becoming increasingly susceptible to fires. In 2025 alone, wildfires scorched over 430 hectares of forest in nine regions, including Varzob and Penjikent. Compounding the crisis is inadequate infrastructure. “There are no roads, equipment cannot reach the area, and the material and technical base is poorly developed,” said Davlatali Sharifzoda, Deputy Director of the Forestry Agency. Rising temperatures are also fueling the spread of pests such as bark beetles, which threaten rare species already listed in the Red Book of endangered flora. Forest degradation is also contributing to soil erosion, particularly in mountainous areas. This poses a serious threat to agriculture, which occupies 3.7 million hectares of Tajikistan’s land. “Soils are becoming less productive due to rising temperatures and reduced rainfall, which reduces crop yields and complicates the lives of farmers,” said Murod Ergashev, a researcher at the Institute of Soil Science. Tajikistan’s forests are home to approximately 270 species of trees and shrubs, 30 of which are endangered. Biologist Rustam Muratov warns that ongoing degradation could lead to the irreversible loss of unique ecosystems and endemic species. The Tajik government is taking action. Under the Bonn Challenge, the country has committed to restoring 66,000 hectares of degraded forests by 2030. Plans include planting drought-resistant species, such as pistachio, walnut, and saxaul. The national forest sector development program for 2022-2026 aims to modernize nurseries, expand seedling production, and establish industrial plantations. The goal is to restore 15,000 hectares of forest, double forest productivity, and reduce livestock grazing in forest areas by 30%. Community involvement is key to sustainable forest management. In the Sangvor and Shokhin districts, local residents, with support from the FAO, participate in regulated harvesting of berries and medicinal plants. Tajikistan’s forests yield significant resources annually, including 120 tons of pistachios, 200 tons of rose hips, 122 tons of walnuts, 15 tons of almonds, 13 tons of honey, and other natural products.

Hydropower, Social Media and Climate Change: Some News From Tajikistan That You May Have Missed

Drought Triggers Power Rationing at Nurek Hydro Station

In early December, the Tajik government reintroduced electricity rationing after reservoir levels at the Nurek Hydroelectric Power Station fell sharply, due to an unusually dry autumn. The station normally supplies around 70% of the national grid, but current water levels are significantly below last year’s benchmark, affecting both domestic consumption and exports. According to Reuters, water levels have dropped more than three meters in the past month. With shortages now affecting many regions, authorities have ordered public buildings to cut electricity outside of working hours and have switched off most street lighting. Tajikistan is seeking emergency imports from Uzbekistan, Turkmenistan and Kazakhstan to stabilize supply. The crisis highlights vulnerabilities in a system dominated by hydropower. While Tajikistan has invested heavily in modernizing Nurek and other plants to improve winter reliability, lower precipitation remains a persistent threat. For regional energy markets, particularly those looking at cross-border electricity trade, the situation demonstrates how even large renewable systems are becoming more unpredictable under climate stress.Rogun: Progress, Profits, and Persistent Disputes

Ambition continues to define the Rogun hydropower project, intended to make Tajikistan a top electricity exporter in the Eurasia region. With a projected capacity of 3,780 MW, Rogun is designed to host the world’s tallest dam. Financing momentum is building: the Asian Infrastructure Investment Bank has launched a $500 million multi-phase initiative, and Tajikistan has signed an energy-sale agreement with Uzbekistan at 3.4 US cents per kWh, paving the way for long-term regional integration. But Rogun’s size continues to attract scrutiny, especially downstream. An investigation has been approved by the World Bank’s Inspection Panel into claims from Uzbekistan and Turkmenistan that altered flows on the Amu Darya river could damage farmland and ecosystems. The project’s social footprint is also expanding, with resettlement estimates reaching as high as 60,000 people. Development banks have slowed some financing, pending stricter environmental and regional safeguards. Local environmental researchers and activists argue that international oversight is still insufficient, warning that the cumulative ecological impact of Central Asian dam-building could become irreversible if accountability is delayed.Digital “Likes” Decriminalised, But Restrictions Remain

President Emomali Rahmon has signed amendments to remove criminal penalties for “liking” or otherwise reacting to online content labelled as "extremist". Under previous legislation, social media users could face up to 15 years in prison for interacting with banned material. More than 1,500 people have been prosecuted under those rules, according to Reuters. The government presented the reform as a correction of overly zealous enforcement, following Rahmon’s public criticism of harsh prosecutions. Yet rights monitors see only minimal change. The latest Human Rights Watch report on Tajikistan notes a continued clampdown on media, opposition figures and citizen journalists. The Committee to Protect Journalists ranks Tajikistan among the most restrictive media environments in Eurasia. European officials have echoed these concerns. An OSCE-backed statement by European embassies denounced the opaque eight-year treason conviction of journalist Rukhshona Khakimova, reportedly linked to analysis of Chinese policy. For many observers, the relaxed online “like” regulations are an incremental change overshadowed by broader structural controls over speech.Glacier Diplomacy and the Fight for Water Security

Tajikistan’s climate diplomacy is drawing global attention. The UN has designated 2025 as the International Year of Glaciers’ Preservation following a proposal from Dushanbe, with March 21 now marked as World Glacier Day. This year, Tajikistan hosted a High-Level International Conference on Glaciers’ Preservation co-organized with UNESCO and the World Meteorological Organization, producing the “Dushanbe Glacier Declaration” to expand global ice monitoring and climate finance for mountain regions. Scientific collaboration is growing alongside diplomacy. Researchers working with the Ice Memory Foundation have completed deep drilling in the Pamirs, extracting two 100-meter frost cores that will be archived for long-term climate study. These samples are especially valuable because the Pamirs contain some of Central Asia’s last relatively stable ice formations, even as Tajikistan has already lost over 1,000 glaciers. Given that the region’s water supply depends heavily on mountain ice, Tajikistan’s leadership in this area has global ripple effects. As a recent Glacier-loss study reported by The Guardian warns that nearly 40% of glaciers worldwide are already “doomed” to melt, Central Asian water security may increasingly influence geopolitics, agriculture and energy production across Eurasia.Sunkar Podcast

Central Asia and the Troubled Southern Route