Turkmen Football Fans Moved to Worse Seats for Match with Cristiano Ronaldo’s Al-Nassr

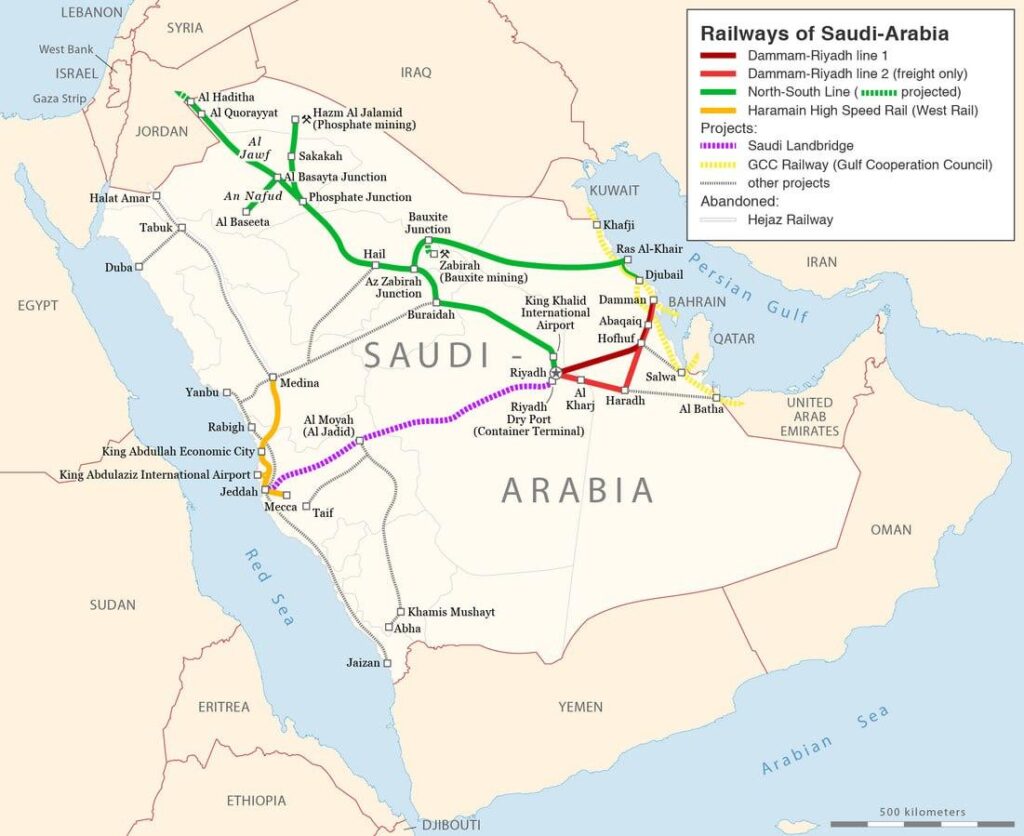

Fans who have bought tickets to the upcoming Asian Champions League match between Turkmenistan's Arkadag and Saudi Arabia’s Al-Nassr on February 11 have been informed, sometimes repeatedly, that their seats are being changed to make room for “organized support” groups. According to a source in Ashgabat, notifications are being sent via users’ personal accounts on ticketing platforms. The vacated sections, the source said, are being allocated to students who are reportedly being trained in advance to provide choreographed support for the home team. Affected spectators are often offered seats with worse visibility, and in many cases, fans, especially families and groups, are being split across different sectors of the stadium, making it nearly impossible to watch the match together. Public frustration has grown as a result. “A 45,000-seat stadium was specifically allocated for this match. If officials had plans for some sections, they could have decided in advance and sold tickets accordingly. If they can’t even organize one match properly, how can we expect them to handle more serious events?” the source said. Some fans have opted not to attend the match at all, despite having already paid for tickets. Others are seeking to resell their tickets, though doing so is complicated. Ticket purchases required passport details, and it is believed that ID checks may be enforced at the gates, making resale risky. Adding to the discontent is the asymmetry in ticketing policy: the Ashgabat city administration’s ticket regulations prohibit buyers from exchanging or returning tickets, while allowing organizers to unilaterally reassign seats. According to reports, the most prominent seating sections will not be occupied by club supporters, but by students compelled to rehearse chants and routines for the game. Arkadag will host Al-Nassr in the last 32 round of the AFC Champions League. The Saudi club’s lineup includes global football star Cristiano Ronaldo. The return leg is scheduled to take place in Saudi Arabia on February 17 or 18.

Spotlight on Central Asia: New Episode Available Now with Eduards Stiprais, EU Special Representative for Central Asia

As Managing Editor of The Times of Central Asia, I’m delighted that, in partnership with the Oxus Society for Central Asian Affairs, from October 19, we are the home of the Spotlight on Central Asia podcast. Chaired by seasoned broadcasters Bruce Pannier of RFE/RL’s long-running Majlis podcast and Michael Hillard of The Red Line, each fortnightly instalment will take you on a deep dive into the latest news, developments, security issues, and social trends across an increasingly pivotal region. This week, the team is joined by the EU Special Representative for Central Asia, Eduards Stiprais, to discuss connectivity, critical minerals, and what's unique about the EU's engagement with Central Asia.

Jackson-Vanik Repeal Gains Momentum as U.S. Courts Central Asia

For many years, U.S. relations with Central Asia were primarily political in nature, while economic ties developed slowly. However, in the past year, engagement has intensified significantly, with recent agreements suggesting the U.S. is poised to strengthen its economic presence in the region. A recent statement by U.S. Secretary of State Marco Rubio reinforces this outlook. Calls to repeal the outdated Jackson-Vanik trade restrictions have been framed by U.S. officials as a way to facilitate trade with Central Asia and strengthen U.S. energy security. The Jackson-Vanik Amendment The Jackson-Vanik Amendment, enacted in 1974, restricts trade with countries that limit their citizens’ right to emigrate. At the time of its passage, Central Asia was still part of the Soviet Union. The amendment prohibits granting most-favored-nation (MFN) status, government loans, and credit guarantees to countries that violate their citizens’ right to emigrate, and allows for discriminatory tariffs and fees on imports from non-market economies. The amendment was repealed for Ukraine in 2006, and for Russia and Moldova in 2012. However, it remains in effect for several countries, including Azerbaijan, Kazakhstan, Tajikistan, Turkmenistan, and Uzbekistan, which continue to receive only temporary normal trade relations. In May 2023, a bill proposing the establishment of permanent trade relations with Kazakhstan, which included repealing the Jackson-Vanik Amendment, was introduced in the U.S. Congress. A follow-up bill with similar provisions was submitted in February 2025. Then-nominee and now Secretary of State Marco Rubio previously noted that some policymakers viewed the amendment as a tool to extract concessions on human rights or to push Central Asian states toward the U.S. and away from Russia. However, he characterized such thinking as outdated, stating that, “In some cases, it is an absurd relic of the past.” Rubio has consistently supported expanding U.S. ties with Central Asia. Expanding Cooperation In 2025, relations between the U.S. and Central Asia deepened significantly, particularly with Kazakhstan and Uzbekistan, which are seen by analysts as the primary beneficiaries of this cooperation. In late October 2025, U.S. Deputy Secretary of State Christopher Landau and U.S. Special Representative for South and Central Asia Sergio Gor visited Kazakhstan and Uzbekistan. One of the year’s major events was the Central Asia-U.S. (C5+1) summit held in Washington on November 6. Leaders of the five Central Asian states met with President Donald Trump and members of the U.S. business community. Uzbekistani President Shavkat Mirziyoyev also met with U.S. Senator Steve Daines, co-chair of the Senate Central Asia Caucus, with both sides focusing heavily on economic cooperation. At the summit, Uzbekistan finalized major commercial agreements with U.S. companies, including aircraft orders by Uzbekistan Airways and deals spanning aviation, energy, and industrial cooperation. Kazakhstan signed agreements worth $17 billion with U.S. companies in sectors including aviation, mineral resources, and digital technologies. This included a deal granting American company Cove Kaz Capital Group a 70% stake in a joint venture to develop one of Kazakhstan’s largest tungsten deposits, an agreement valued at $1.1 billion. Further agreements were signed on critical minerals exploration. Kazakhstan and the U.S. committed to joint development of these resources, while Uzbekistan signed similar agreements with Denali Exploration and Re Element Technologies. Central Asia holds nearly 170 identified rare earth element occurrences. Experts argue the region’s largely untapped reserves could provide a viable alternative to China’s near-monopoly on the global supply chain. Strategic Balancing In November 2025, Kazakhstan announced its accession to the Abraham Accords. The Foreign Ministry stated that this move aligns with Kazakhstan’s strategic interests and commitment to a fair resolution of the Middle East conflict. The Abraham Accords, initially signed in 2020, normalized relations between Israel and several Arab nations, including the UAE, Bahrain, and Morocco, with the U.S. acting as mediator. In January 2026, Kazakhstan, Uzbekistan, and Azerbaijan joined the Trump-initiated Board of Peace as founding signatories. According to the draft charter, extended or permanent membership may require significant financial contributions. An Economic Shift Toward Central Asia Central Asia was long a peripheral concern for U.S. foreign and economic policy. That began to change following the outbreak of the war in Ukraine and amid rising concerns over China's control of rare earth markets. Kazakhstan has identified at least 15 rare earth deposits and occurrences, many of which are crucial for modern technologies. Kazakhstan hosts some of the world’s largest undeveloped tungsten deposits. The U.S. approach to regional cooperation has shifted significantly under President Trump, who has prioritized deal-making and economic interests. Still, the extent to which Kazakhstan and Uzbekistan are prepared to help the U.S. compete with China remains unclear. Beijing remains Central Asia’s largest economic partner, even surpassing Russia. In 2025, trade between China and Central Asia totaled $106.3 billion, a 12% increase year-on-year. In contrast, U.S. trade with Kazakhstan, its top regional partner, amounted to around $5.5 billion in 2024, making Kazakhstan by far the United States’ largest trade partner in Central Asia. While recent agreements may improve this imbalance, closing the gap with China will be a long-term challenge. Nonetheless, repealing the Jackson-Vanik Amendment could mark a pivotal step. “From an economic point of view, the Jackson-Vanik amendment has not directly restricted U.S. trade with Central Asian countries in recent years," political commentator Janibek Suleev told The Times of Central Asia. "Most already enjoy normal trade relations.” However, Suleev noted that a full repeal of the amendment could offer several upgrades, most importantly, an improved investment climate. “This is particularly relevant for hydrocarbon projects, energy, transport infrastructure, and the processing of critical minerals. The regional economy could also access new markets beyond China and Russia,” he stated. Suleev argued that the political significance of any repeal outweighs the economic effect. “Central Asia has become a stage for strategic rivalry between China, Russia, and the West. A new model is now emerging. From recent developments, it appears Washington is aiming to expand bilateral ties without formal alliances,” he said, cautioning that a dramatic increase in U.S. investment should not be expected. “Still, the shift is clear. For most of the post-independence period, U.S. engagement focused heavily on promoting human rights and democratic norms," Suleev concluded. "Today, relations are taking a more pragmatic turn.”

TAPI Gas Pipeline Advances Toward Herat, Afghanistan

Progress on the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline, one of the largest energy infrastructure projects in the region, was the central focus of recent talks between Turkmenistan’s Ambassador to Afghanistan, Khoja Ovezov, and Afghanistan’s Minister of Mining and Petroleum, Hedayatullah Badri. According to Turkmenistan’s state oil and gas company, Turkmennebit, the Turkmen delegation briefed its Afghan counterparts on the current phase of construction and outlined upcoming steps. Both sides expressed optimism that the pipeline will reach the western Afghan city of Herat by the end of 2026, a key milestone for the project. The TAPI pipeline is projected to span approximately 1,814 kilometers, with 214 kilometers running through Turkmenistan, 774 kilometers through Afghanistan, and 826 kilometers through Pakistan, ending at the Indian border. The Afghan segment is not only the longest outside of Pakistan but also the most challenging, both logistically and politically. The most recent development in the project, the opening of the Serhetabat-Herat section, officially named Arkadagyň ak ýoly (“Arkadag’s White Path”), was marked on October 20, 2025. Once operational, the pipeline is expected to bring substantial economic benefits to the participating countries. Afghanistan could receive over $1 billion annually in transit and related revenues, while Pakistan is projected to earn between $200 million and $250 million. These figures, according to project stakeholders, represent a significant step toward the economic goals of each nation involved. Preparatory work has already been completed on a 91-kilometer stretch of the TAPI route in Herat province. The necessary infrastructure is in place, and worker camps have been established along the pipeline corridor.

Analysis: Three Decades of Parliamentary Reform in Central Asia — and What Changed

Kazakhstan’s President Kassym-Jomart Tokayev announced his reform plans on January 20, including structural changes to the government. Arguably, one of the least consequential of those changes is replacing the current bicameral parliament with a unicameral parliament. Across Central Asia, over the last 35 years, parliaments have repeatedly switched from unicameral to bicameral parliaments, or vice versa, the number of deputies has increased and decreased, and in some cases, parallel bodies have come into existence and later disappeared. Kazakhstan When the Soviet Union collapsed in late 1991, each of the former republics, including the Central Asian countries of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, had a unicameral, republican Supreme Soviet elected in 1990. These Supreme Soviets continued functioning after independence until 1994, and in the case of Kyrgyzstan and Tajikistan, until 1995. In Kazakhstan, in December 1993, the majority of the 360 deputies in the Supreme Soviet voted to dissolve the body. In March 1994, there were elections to the new parliament (Supreme Kenges) that had 177 seats. During the tumultuous year of 1995, the parliament was dissolved by then-President Nursultan Nazarbayev, who ruled by decree until snap parliamentary elections in December of that year. However, on August 29, 1995, voters approved a new constitution in a national referendum. That constitution created a bicameral parliament with 67 deputies in the Mazhilis, the lower house, and 50 deputies in the Senate, 10 of them directly appointed by the president. Deputies to the Mazhilis were chosen in popular elections. Senators were chosen in indirect elections involving deputies from local, provincial, and municipal councils of large cities. In the snap parliamentary elections of October 1999, 10 seats were added and chosen by party lists, while the original 67 continued to be contested in single-mandate districts. That structure lasted until 2007. Constitutional amendments adopted in late May that year increased the number of seats in the Mazhilis to 107, of which 98 were to be chosen by party lists. Nazarbayev’s Nur-Otan party won all 98 of the party list seats in the August elections. The remaining nine representatives came from the Assembly of Peoples of Kazakhstan, a group representing the various ethnic groups in Kazakhstan that Nazarbayev created in 1995. Eight additional members of the Assembly were given seats in the Senate. The Assembly held its own elections to fill those seats. Kazakhstan conducted a constitutional referendum in June 2022, in part aimed at mollifying discontent that lingered from the mass unrest in early January that year, which left 238 people dead. Some amendments stripped away powers in the executive branch that had accumulated during the 28 years Nazarbayev was president, and more power was given to parliament. Another amendment removed the nine Mazhilis seats reserved for members of the Assembly of Peoples of Kazakhstan. One amendment reduced the number of Senate members appointed by the president back to 10, after it had been raised to 15 under a 2007 amendment. Kyrgyzstan A referendum in Kyrgyzstan on constitutional amendments in October 1994 created a bicameral parliament with 70 seats in the Legislative Assembly, the lower house, and 35 in the Assembly of People's Representatives, the upper house. Kyrgyzstan’s first parliamentary elections were held in February 1995. When the 2000 parliamentary elections came around, the number of seats was slightly altered: 60 in the Legislative Assembly, and 45 in the Assembly of People’s Representatives. The referendum of 2003 changed the structure again, creating a unicameral parliament with 75 seats for the 2005 elections. In October 2007, another constitutional referendum enlarged parliament to 90 seats and stipulated that they all would be filled in elections by party lists. In June 2010, less than three months after Kurmanbek Bakiyev was ousted as Kyrgyzstan’s president, a referendum was conducted that changed Kyrgyzstan’s form of government from presidential to parliamentary and increased the number of deputies to 120. Kyrgyzstan’s 2020 parliamentary elections were rife with accusations of vote-buying, gerrymandering, and the use of administrative resources to fill parliament with presidential loyalists. The results announced in October supported these suspicions. That sparked unrest in the capital, Bishkek. Sooronbai Jeenbekov was ousted as Kyrgyzstan’s president in October 2020 and quickly replaced by Sadyr Japarov, Kyrgyzstan’s current president. A referendum in April 2021 approved turning Kyrgyzstan back to a presidential form of government, with Japarov arguably enjoying greater powers than any previous Kyrgyz president. The referendum also reduced the number of seats in parliament back to 90. Another amendment in that referendum raised the status of Kyrgyzstan’s People’s Kurultai to a “public representative assembly… a deliberative, supervisory assembly, making recommendations on areas of social development.” A Kurultai is an ancient Turkic and Mongol tradition of assembling communities, or representatives of communities, to discuss important matters, including the selection of new leaders. In Kyrgyzstan, national Kurultais have been called previously, usually during times of great social tension or by Kyrgyz presidents seeking support from a group that is supposed to represent traditional Kyrgyz values. The status of Kyrgyzstan’s People’s Kuriltai under the current constitution is not clearly defined, but some see it as potentially a parallel structure to parliament. Parliamentary elections in November 2021 were decided under a split-system of 54 seats contested by party lists and 36 in single-mandate districts. In the November 2025 elections, single-mandate districts filled all 90 seats. Tajikistan Less than a year after it became independent, there was a civil war in Tajikistan that lasted until June 1997. The Supreme Soviet remained until 1995, and after the post of president was removed in November 1992, the chairman of the Supreme Soviet, at that time Emomali Rahmon (Rahmonov), was made the head of state. A referendum in November 1994 approved a new constitution that created a 181-seat unicameral parliament, and elections for that parliament were held in February 1995. The Tajik Peace Accord was signed on June 27, 1997, ending the civil war. In 1999, a new constitution established a bicameral parliament with 63 seats in the Majlisi Namoyandagon, the lower house of parliament, elected by party lists, and 33 seats in the Majlisi Milli, the upper house, elected by representatives of city, regional, and district administrations. That arrangement has endured to this day. Turkmenistan The constitution that Turkmenistan adopted in May 1992 created a parliament with 50 seats, and that number remained until the 2008 parliamentary elections. However, after a November 2002 attack on President Saparmurat Niyazov’s motorcade, state investigators said the organizers of the attack planned to kill Niyazov, then convene parliament to approve new leadership. In August 2003, Niyazov increased the powers of a consultative body called the Halk Maslahaty (People’s Council) that had previously met once a year to rubber-stamp presidential policies, including making Niyazov “president for life” at a session in 1999. The Halk Maslahaty was comprised of a variety of people: all the parliamentary deputies, local officials, businessmen, religious figures, and others from around the country. More than 2,500 in all. It was therefore impossible to gather them all quickly, and Niyazov subordinated parliament to the Halk Maslahaty. Niyazov died in December 2006, and his successor, Gurbanguly Berdimuhamedov, introduced amendments to the constitution in September 2008 that abolished the Halk Maslahaty and increased the number of seats in parliament to 125. The parliamentary elections later in 2008 were also notable for being the first time the ruling Democratic Party of Turkmenistan (formerly the Communist Party of the Turkmen SSR) faced competition. The government created two new parties to give the appearance of conducting competitive elections. The number of parliamentary seats remained 125, but in 2017, Berdimuhamedov told a meeting of the Council of Elders that he was reforming the group into a new Halk Maslahaty that includes citizens of different ages. Changes adopted to Turkmenistan’s constitution in late 2020 led to the creation of a bicameral parliament in early 2021, with parliament becoming the lower house and the Halk Maslahaty the upper house. Berdimuhamedov stepped down as president in early 2022 after having spent several years preparing his son Serdar to take the post. The elder Berdimuhamedov then took the post of Halk Maslahaty chairman. In January 2023, parliament amended the constitution. The Halk Maslahaty was made the supreme body in the country, with parliament reverting to its unicameral form, and the Halk Maslahaty’s chairman becoming the country’s most powerful politician, more powerful than the president. Uzbekistan Voters in Uzbekistan elected 250 deputies to the unicameral parliament in the elections of 1994 and 1999. The January 2002 referendum approved the creation of a bicameral parliament with 120 seats in the Oliy Majilis, the lower house, and 100 seats in the Senate, the upper house. Voters only cast ballots for deputies in the Oily Majlis. In the Senate, 84 members were elected by provincial, district, and city councils, and 16 were selected by the president. They took office after the 2004 elections. Before the 2009 parliamentary elections, an additional 30 seats were added to the Oliy Majlis. However, 15 of these places were reserved for members of the Ecological Movement. The Uzbek authorities were pressuring Tajikistan not to go ahead with plans to build a massive hydropower plant (HPP), Rogun, upstream. Uzbekistan’s Ecological Movement was spearheading the criticisms against Tajikistan even before its inclusion in parliament. Uzbekistan’s first president, Islam Karimov, died in the summer of 2016. His successor, Shavkat Mirziyoyev, reversed Uzbekistan’s position on the Rogun HPP and declared that Uzbekistan would work with Tajikistan to build it. The first parliamentary elections held after Mirziyoyev came to power were in 2019. Before those elections, the Ecological Movement became the Ecological Party and had to compete for seats in the Oliy Majlis, like the other parties. Constitutional amendments in 2023 reduced the size of the Senate to 65 members, four from each of Uzbekistan’s 12 provinces, the Karakalpakstan Republic, and Tashkent city, with the president appointing the remaining nine members. Round in Circles Kazakhstan’s new unicameral parliament will be called the Kurultai. It will have 145 deputies elected on the basis of party lists. It appears the rule will stand that only candidates from officially registered parties will be able to participate in elections. That is also true in all the other Central Asian states except Kyrgyzstan, the only country that still allows independent candidates to run. All the Central Asian states have seen their parliaments transformed, expanded, and contracted. Every time, there were reasons given why these changes represented political and social progress. Yet after 35 years, the decisions in each country are still made by one man, the president (or in Turkmenistan’s case, the Halk Maslahaty chairman), and a small inner circle. The changes coming to Kazakhstan could herald a new era of politics in that country, but in the past, such changes have usually been window-dressing, not substantive political change.

Between Statistics and Reality: What the UNICEF Report Reveals About Children in Turkmenistan

The State Committee on Statistics of Turkmenistan, in partnership with UNICEF, has released the report “Census 2022 - The Situation of Children in Turkmenistan”. However, as noted by independent outlet turkmen.news, the report is based on official census data that many experts consider unreliable or inflated, potentially skewing the findings. Despite these concerns, the report offers insight into the country’s demographic and social trends. According to the report, Turkmenistan has a notably “young” population: children aged 0-14 make up 30.7% of the total. In total, 2,463,258 individuals under the age of 17 account for more than one-third of the population. However, a decline in the birth rate is evident: there are 1.2 times fewer children in the 0-4 age group compared to those aged 5-9. Household composition data reveals that families with three or more children are the most common, comprising 43% of all households nationally and 48.9% in rural areas. Families with two children account for 31.1%, and those with one child, 25.9%. This distribution correlates with a broader demographic pattern, 57.8% of all children in Turkmenistan live in rural areas. The demographic dependency ratio remains high: there are 755 dependents per 1,000 working-age individuals. Notably, the child dependency rate is 4.3 times higher than that of the elderly, suggesting a sizable future labor force. The urban-rural divide is also apparent here: in rural areas, the child dependency ratio is 698, compared to 525 in urban centers. The report addresses early marriage and childbirth: among 15-17-year-olds, 1,349 boys (0.9%) and 1,770 girls (1.2%) were in either registered or de facto marriages. Within the same age group, 339 girls had already given birth. The highest rate of teenage births was recorded in Akhal region (4.2 per 1,000), while Ashgabat reported the lowest (1.2 per 1,000). Childhood disability statistics show mobility and stair-climbing difficulties are the most prevalent, affecting 3,106 children aged 5-17. Other reported issues include concentration and memory problems (1,989 cases), hearing impairments (1,791), and visual impairments (1,784). In all categories, boys outnumber girls. One of the most striking disparities is in preschool access. Only 23.8% of children in rural areas attend preschool, compared to 64.7% in urban areas, a rural-urban equity index of just 0.37. Given that the majority of children live in rural areas, the gap reflects systemic challenges, including insufficient infrastructure, transportation issues, and household dynamics where caregiving typically falls to women. Enrollment rates improve significantly for older children. Nearly all children aged 6-15 are in school, with only 0.3-0.4% not attending. However, the dropout rate increases in older age groups, with 5.4% of adolescents not enrolled in school or vocational institutions. No significant gender disparities were observed in this regard. Despite the insights the report offers, it is underpinned by 2022 census data that many independent experts argue is inflated. While Turkmenistan's official population stands at around 7 million, alternative estimates range between 2.7 and 5.7 million. Nevertheless, the release of this report marks a step toward a more open dialogue about the country’s social policies. Regardless of potential inaccuracies, the youthful demographic profile suggests significant developmental potential and a growing obligation for the state to prioritize education and family support systems.

Central Asia Launches Regional Electricity Market with World Bank Support

On January 22, the World Bank’s Board of Executive Directors approved the 10-year Regional Electricity Market Interconnectivity and Trade (REMIT) Program, an ambitious initiative to establish Central Asia’s first regional electricity market. The program aims to boost cross-border electricity trade, expand transmission capacity, and lay the foundation for large-scale renewable energy integration across the region. Electricity demand in Central Asia is projected to triple by 2050 under a business-as-usual scenario. Yet electricity trade in the region currently accounts for only 3% of total demand. The REMIT Program seeks to harness Central Asia’s diverse and complementary energy resources: hydropower in Kyrgyzstan and Tajikistan, thermal power from coal and natural gas in Kazakhstan, Turkmenistan, and Uzbekistan, and the region’s rapidly expanding solar and wind potential. Over the next decade, REMIT aims to:

- Increase regional electricity trade to at least 15,000 GWh annually, enough to supply millions of consumers

- Triple regional transmission capacity to 16 GW

- Enable up to 9 GW of clean energy integration

Finland’s President Stubb Warns Russia’s Imperial Thinking Poses Risks for Central Asia

Russia’s imperial worldview may pose a greater long-term risk to Central Asia and the South Caucasus than to NATO member states, Finnish President Alexander Stubb said in an interview with The Washington Post, highlighting concerns that continue to resonate across the post-Soviet space. Speaking with columnist David Ignatius, Stubb referenced Finland’s long and complex history with its eastern neighbor, noting that expansionist thinking remains deeply rooted in Russian political culture. “I think the DNA of Russia is still expansion and imperialism,” he said, arguing that President Vladimir Putin views the collapse of the Soviet Union as a historical injustice. While much of the Western debate centers on potential threats to NATO countries such as the Baltic states, Finland, or Poland, Stubb suggested that more vulnerable regions lie elsewhere. “I think the more worrying aspect for others is the Central Asian countries, the Southern Caucasus and others,” he said, pointing to what he described as a top-down political system driven by the ideology of Russkiy mir, or the “Russian world.” Stubb also spoke about his personal interactions with Russian officials, including Putin and Foreign Minister Sergei Lavrov, stressing that meaningful political dialogue remains unlikely while the war in Ukraine continues. As previously reported by The Times of Central Asia, Russian television host Vladimir Solovyov sparked backlash after suggesting that Moscow could conduct “special military operations” in Central Asia and Armenia. The remarks were widely condemned by Uzbek scholars, journalists, and analysts as destabilizing and provocative. More recently, Russian ultranationalist Alexander Dugin, often described as an ideologue of the “Russian world”, publicly questioned the sovereignty of several former Soviet republics, including Uzbekistan, Kazakhstan, Tajikistan, and Kyrgyzstan. A video of his comments circulated widely online, drawing sharp criticism across the region. Russia’s Foreign Ministry later sought to distance the Kremlin from such statements. Spokesperson Maria Zakharova stated that Solovyov’s remarks did not reflect official policy and reaffirmed that Moscow’s relationships with Central Asian countries are based on partnership and respect for sovereignty.

Sunkar Podcast

Central Asia and the Troubled Southern Route